As filed with the Securities and Exchange Commission on April 6, 2020

Registration No. 333-230658

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S–1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

| Artelo Biosciences, Inc. |

| (Exact name of Registrant as specified in its charter) |

| Nevada |

| 7389 |

| 33-1220924 |

| (State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

| 888 Prospect Street, Suite 210 La Jolla, CA 92037 (760) 943-1689 |

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

| Gregory D. Gorgas Chief Executive Officer and President 888 Prospect Street, Suite 210 La Jolla, CA 92037 Telephone: (760) 943-1689 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Martin J. Waters

Wilson Sonsini Goodrich & Rosati, P.C.

12235 El Camino Real

San Diego, CA 92130

Telephone: (858) 350-2300

Facsimile: (858) 350-2399

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

|

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(c) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(c), may determine.

|

|

EXPLANATORY NOTE

On April 1, 2019, Artelo Biosciences, Inc. (the “Company”) filed a registration statement with the Securities and Exchange Commission (the “SEC”) on Form S-1 (File No. 333-230658) (as amended, the “Registration Statement”). The Registration Statement was originally declared effective by the Securities and Exchange Commission on June 20, 2019. The Registration Statement covered (i) 1,300,813 units with each unit consisting of one share of common stock, par value $0.001 per share (the “Common Stock”) and one warrant to purchase one share of Common Stock (the “Underlying Warrants”), (ii) 191,102 additional warrants sold to the underwriters pursuant to their overallotment option (these warrants and the Underlying Warrants, the “Public Warrants”), plus the underlying shares of Common Stock issuable upon exercise of the Public Warrants and (iii) 104,065 underwriter’s warrants (the “Underwriter’s Warrants”), plus the underlying shares of Common Stock issuable upon exercise of the Underwriter’s Warrants.

This Post-Effective Amendment No.1 to the Registration Statement is being filed to (i) include an updated prospectus relating to the offering and sale of 1,595,980 shares of the Company’s common stock issuable upon exercise of the Public Warrants and the Underwriter’s Warrants and (ii) update and supplement, among other things, the information contained in the Registration Statement to incorporate by reference the information contained in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2019, that was filed with the SEC on November 25, 2019, as amended (the “Annual Report”) and the Company’s Quarterly Report on Form 10-Q for the quarter ended November 30, 2019 that was filed with the SEC on January 14, 2020 (the “Quarterly Report”). The Annual Report and the Quarterly Report are incorporated by reference herein and are listed in “Part I – Incorporation of Certain Information by Reference.”

|

|

No additional securities are being registered under this Post-Effective Amendment. All applicable registration and filing fees were paid at the time of the original filing of the Registration Statement.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, APRIL 6, 2020

ARTELO BIOSCIENCES, INC.

1,595,980 Shares of Common Stock (par value $0.001 per share)

__________________________

We are offering 1,595,980 shares of our Common Stock, par value $0.001 per share, issuable upon exercise of warrants issued on a registration statement on Form S-1 as a part of a unit offering, which was declared effective on June 20, 2019 (File No. 333-230658) (as amended, the “Registration Statement”). On June 25, 2019, pursuant to the Registration Statement, we issued (i) warrants to purchase 1,491,915 shares of our Common Stock, with an exercise price of $6.4575 per share (the “Public Warrants”) and (ii) warrants to purchase 104,065 shares of our Common Stock, with an exercise price of $6.7650 per share (the “Underwriter’s Warrants”).

In order to obtain the shares of Common Stock to which this prospectus relates, the holders of the Public Warrants must pay the exercise price. We will receive proceeds from any exercises of the Warrants, but not from the sale of the underlying common stock. Please see the section titled “Plan of Distribution” for more information regarding the offering.

Our common stock and warrants are listed on the Nasdaq Capital Market under the symbols “ARTL” and “ARTLW,” respectively. On March 20, 2020 our last reported sales price of our common stock on the Nasdaq Capital Market was $0.78 per share and our last reported sales price of our Public Warrants was $0.215 per Public Warrant.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startup Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

__________________________

An investment in our securities involves a high degree of risk. Before buying any of our securities you should carefully read the discussion of the material risks of investing in our securities in “Risk Factors” beginning on page 9 of this prospectus.

__________________________

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 6 ,2020

|

|

TABLE OF CONTENTS

|

| Page |

| ||

|

| 1 |

| ||

|

| 9 |

| ||

|

| 36 |

| ||

|

| 37 |

| ||

|

| 38 |

| ||

|

| 38 |

| ||

|

| 39 |

| ||

|

| 41 |

| ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 43 |

| |

|

| 50 |

| ||

|

| 73 |

| ||

|

| 77 |

| ||

|

| 82 |

| ||

| Security Ownership of Certain Beneficial Owners and Management |

| 84 |

| |

|

| 86 |

| ||

|

| 87 |

| ||

|

| 93 |

| ||

|

| 99 |

| ||

|

| 99 |

| ||

|

| 99 |

| ||

|

| F-1 | |||

This updated prospectus is part of the original Registration Statement that we filed with the Securities and Exchange Commission which was declared effective on June 20, 2019. You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful. The information contained in this prospectus is current only as of its date.

For investors outside the U.S.: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

|

|

| Table of Contents |

| PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary may not contain all the information you should consider before investing in our securities. You should carefully read this prospectus in its entirety before investing in our securities, including the sections titled Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations and our financial statements and related notes included elsewhere in this prospectus. Unless the context otherwise requires, the terms Artelo Biosciences, Artelo, the Company, our company, we, us, and our, refer to Artelo Biosciences, Inc.

Corporate Overview

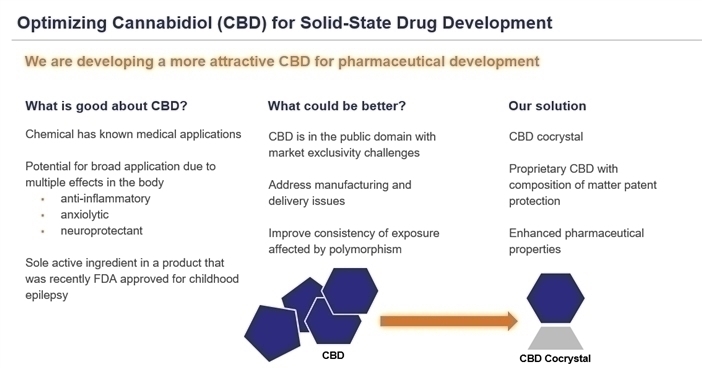

We are a clinical stage biopharmaceutical company focused on developing and commercializing treatments intended to modulate the endocannabinoid system (the “ECS”) and related signaling pathways, including a solid-state composition of cannabidiol (“CBD cocrystal”), with improved pharmaceutical-like properties which could have a meaningful impact on cannabinoid-based drug development. Our management team is highly experienced and has a successful history of development, regulatory approval and commercialization of pharmaceuticals.

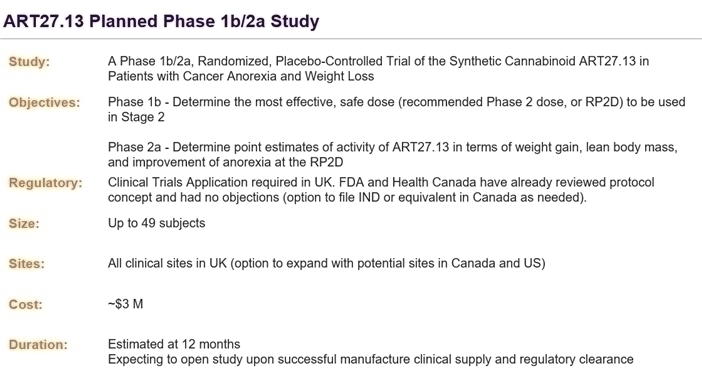

Our product candidate pipeline broadly leverages leading scientific methodologies to ECS modulation, balances risk across mechanism of action and stages of development and represents a comprehensive approach in utilizing the power of the ECS to develop pharmaceuticals for patients with unmet healthcare needs. In addition to our cocrystal program, we are currently developing ART27.13 as treatment for anorexia associated with cancer in a planned Phase 1b/2a trial and ART26.12, which is being studied as an endocannabinoid modulator and cancer therapeutic and is in the late pre-clinical stage. The COVID-19 global pandemic has created uncertainties in the expected timelines for clinical stage biopharmaceutical companies such as us, and because of such uncertainties, it is extremely difficult for us to accurately predict our expected timelines at this time.

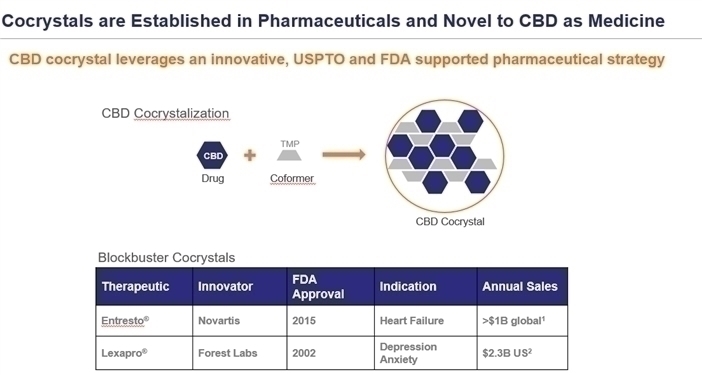

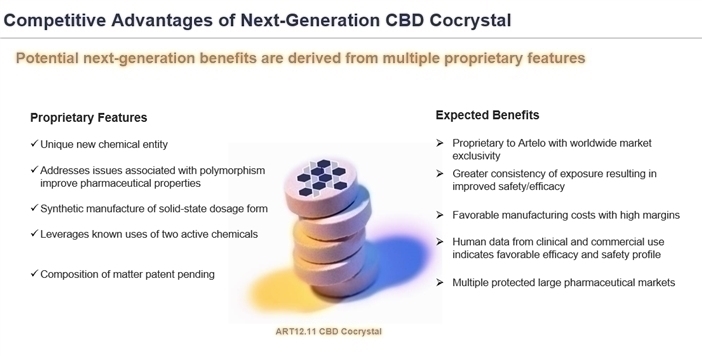

The crystal structure of cannabidiol (“CBD”) is known to exhibit solid polymorphism, or the ability to manifest in different forms. Polymorphism can adversely affect stability, dissolution, and bioavailability of a drug product and thus affect its quality, safety, and efficacy. We have developed a proprietary cocrystal composition of CBD, which we have designated as ART12.11. We believe our cocrystal exists as a single crystal form and as such is anticipated to have advantages over other forms of CBD that exhibit polymorphism. Anticipated advantages of this single crystal structure include improved stability, solubility, and a more consistent absorption profile. We believe these features will result in more consistent bioavailability and may lead to improved safety and efficacy.

U.S. and international patent applications including broad claims to our novel cocrystal composition of CBD were filed in late 2018 and a continuation filing with the United States Patent and Trademark Office (the “USPTO”) in April 2019. On February 7, 2020 the Company disclosed receiving a Notice of Allowance from the USPTO for its composition of matter patent application for the CBD cocrystal. Composition claims are generally known in the pharmaceutical industry as the most desired type of intellectual property and should provide for long lasting market exclusivity for our CBD cocrystal drug product candidate. In addition, due to the reasons outlined above, we believe that our CBD cocrystal will have superior pharmaceutical properties compared to non-cocrystal CBD products under development at other competing companies.

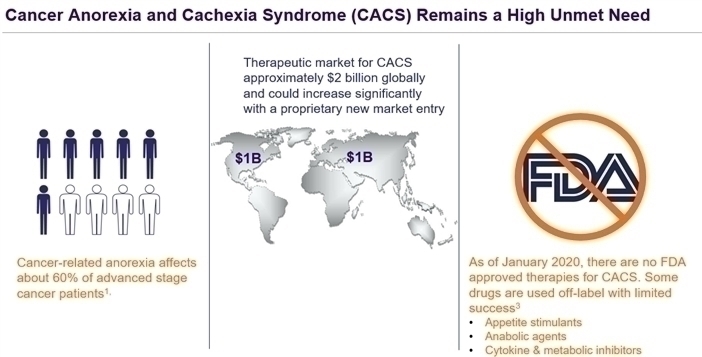

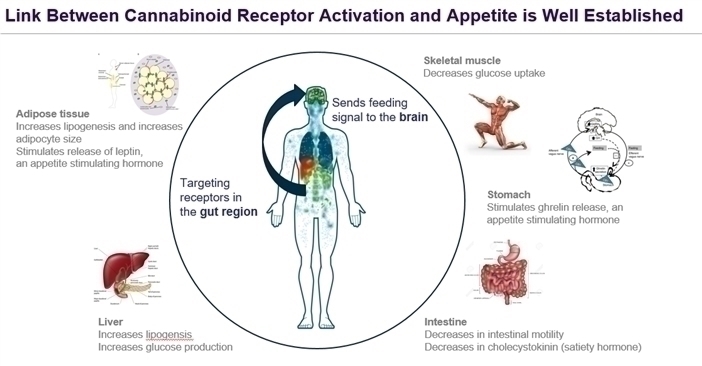

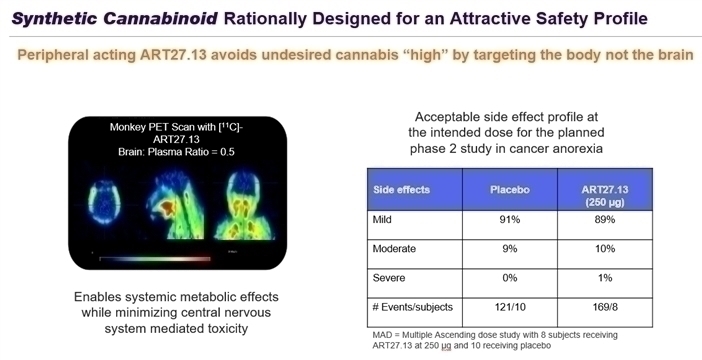

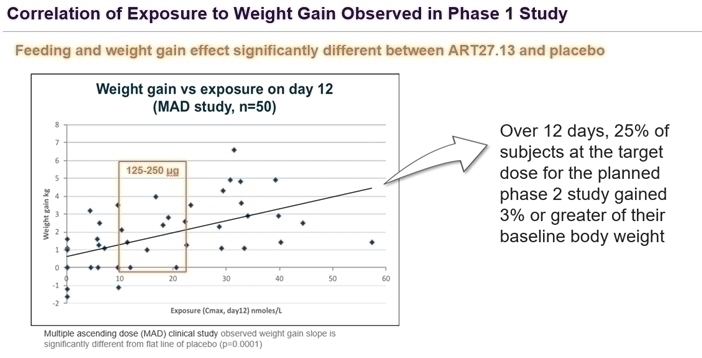

In addition to our own internal discovery research, we are currently developing two patent protected product candidates that we obtained through our in-licensing activities. Our first program is a synthetic small molecule program, ART27.13, being developed for cancer-related anorexia. ART27.13 is a peripherally-restricted high-potency dual CB1 and CB2 receptor agonist which was originally developed at AstraZeneca plc (“AstraZeneca”). We have exercised our option to exclusively license this product candidate through the NEOMED Institute, a Canadian not-for-profit corporation, renamed adMare in June 2019 (“NEOMED”). In Phase 1 single dose studies in healthy volunteers and a multiple ascending dose study in otherwise healthy patients with back pain conducted by AstraZeneca, ART27.13 exhibited an attractive pharmacokinetic and absorption, distribution, metabolism, and excretion profile and was well tolerated within the target exposure range. It also exhibited dose-dependent and potentially clinically meaningful increases in body weight. Importantly, the changes in body weight were not associated with fluid retention or other adverse effects and occurred at exposures without central nervous system (“CNS”) side effects. Discussions with U.K. regulators indicate there is a potential pathway for development of ART27.13 for the treatment of cancer-related anorexia, which affects approximately 60% of advanced stage cancer patients. We are planning to initiate a Phase 1b/2a clinical study of cancer-related anorexia with ART27.13 upon successful completion of manufacturing new study material and when the regulatory authorities in the U.K. permit initiations of new clinical studies which are currently paused due to the global coronavirus pandemic, COVID-19. |

| 1 |

|

|

| Table of Contents |

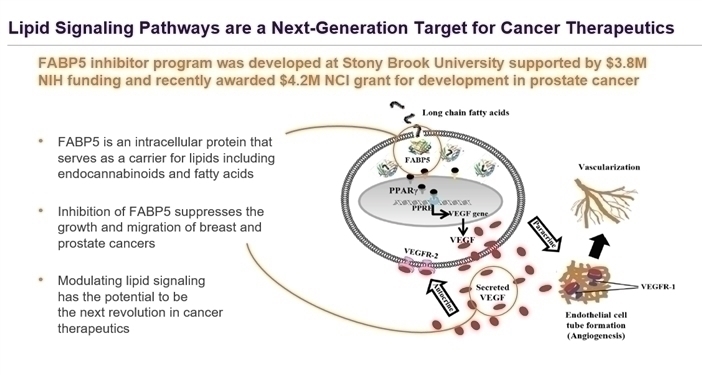

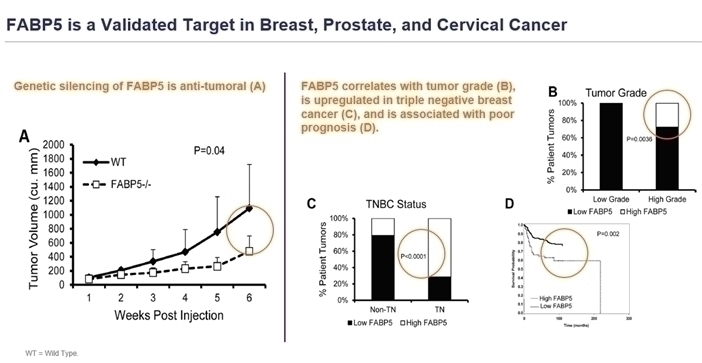

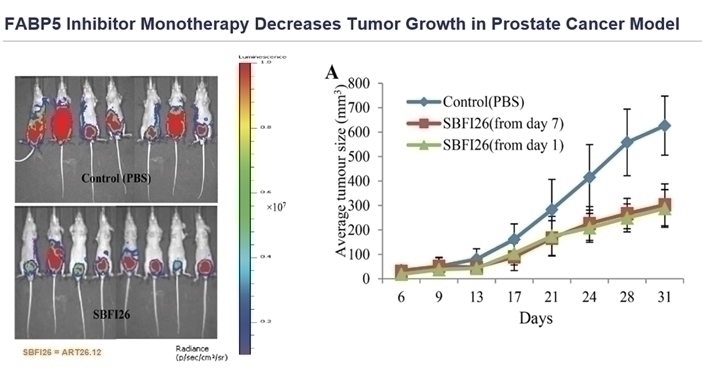

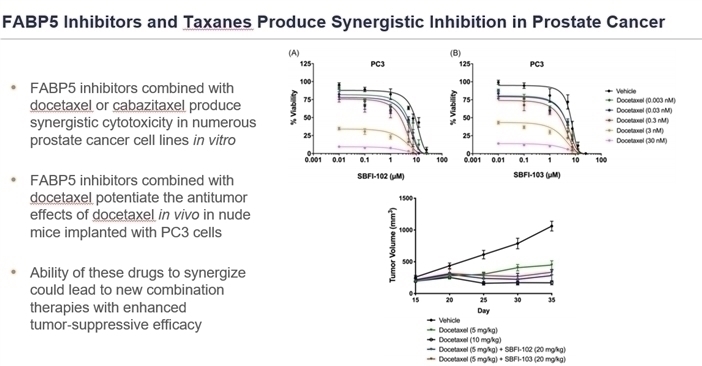

| Our second in-licensed program is a platform of small-molecule inhibitors for fatty acid binding protein 5 (“ FABP5”), based upon scientific developments achieved at Stony Brook University (“SBU”) which we have designated ART26.12. To date, SBU has received nearly $4 million in funding from the National Institutes of Health to begin developing these candidates. Fatty acid binding proteins (“FABPs”) are attractive therapeutic targets, however, their high degree of similarity among the various types has proven challenging to the creation of drugs targeting specific FABPs. FABP5 is believed to specifically target and regulate one of the body’s endogenous cannabinoids, anandamide (“AEA”). While searching for a FABP5 inhibitor to regulate AEA, we believe researchers at SBU discovered the chemistry for creating a highly specific and potent small molecule inhibitor for FABP5. In addition to its potential as an endocannabinoid modulator, FABP5 is also an attractive target for cancer drug development. Large amounts of human clinical epidemiological and animal model data support FABP5 as a well validated oncology therapeutic target, especially for triple negative breast cancer and castration-resistant prostate cancer. We licensed exclusive world-wide rights to these inhibitors from SBU. The program is in the final stages of lead optimization, and we plan to initiate regulatory enabling studies thereafter. We anticipate clinical studies in cancer can begin in 2021.

We are developing our product candidates in accordance with traditional drug development standards and plan to make them available to the general public via prescription or physician orders only after obtaining marketing authorization from a regulatory authority, such as the U.S. Food and Drug Administration (the “FDA”). Our management team has experience developing and commercializing ethical pharmaceutical products, including several first-in-class therapeutics. Based upon our current management’s capabilities and the future talent we may attract, we expect to retain rights to internally develop and commercialize products, however, we may seek collaborations with partners in the biopharmaceutical industry when that strategy serves to maximize value for our stockholders.

Product Candidate Pipeline:

| |||

| Product Candidate | Target Indications | Development Phase | Market Size |

| ART27.13 – Cannabinoid Agonist | Anorexia associated with cancer | Phase 1 | Cancer anorexia cachexia syndrome: $2 billion |

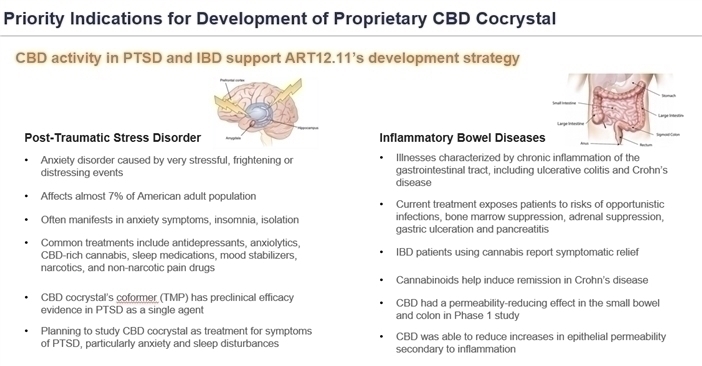

| ART12.11 – CBD Cocrystal | Inflammatory Bowel Disease (IBD) and Post-Traumatic Stress Disorder (PTSD) | Pre-clinical | IBD: $7 billion PTSD: $7 billion |

| ART26.12 – FABP5 inhibitor | Prostate cancer and Breast cancer | Pre-clinical | Prostate cancer: $9 billion Breast cancer: $18 billion |

|

Therapeutics market size based upon total global annual prescription drug sales in 2016, 2017 or 2018

Sources: http://wiseawareness.com/cancer-cachexia-market/;http://www.openpr.com/wiki/global-breast-cancer-therapeutics-market;http://www.globenewswire.com/news-release/2018/09/24/1575060/0/en/Global-Prostate-Cancer-Therapeutics-Market-Will-Reach-USD-17-200-Million-By-2024-Zion-Market-Research.html; http://www.prnewswire.com/news-releases/the-global-inflammatory-bowel-diseases-ibd-drug-market-is-estimated-at-6-7bn-in-2017-and-7-6bn-in-2023--300688523.html; http://www.credenceresearch.com/report/post-traumatic-stress-disorder-therapeutics-market

Background

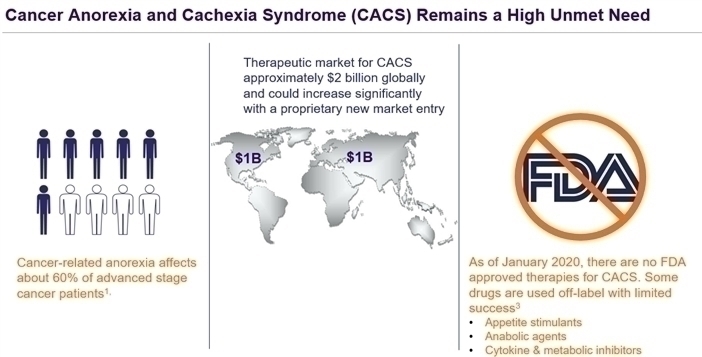

The ECS is composed of cannabinoid receptors, endogenous receptor ligands ( endocannabinoids ) and their associated transporter mechanisms, as well as enzymes responsible for the synthesis and degradation of endocannabinoids, and has emerged as a considerable target for pharmacotherapy approaches of numerous human diseases. As a widespread modulatory system, the ECS plays important roles in the CNS, development, synaptic plasticity, and the response to endogenous and environmental factors.

The modulation of the ECS can be effected by using selective or non-selective agonists, partial agonists, inverse agonists, and antagonists of the cannabinoid receptors, CB1 and CB2. The CB1 receptor is distributed in brain areas associated with motor control, emotional responses, motivated behavior and energy homeostasis. In the periphery, CB1 is ubiquitously expressed in the adipose tissue, pancreas, liver, gastrointestinal tract, skeletal muscles, heart and the reproductive system. The CB2 receptor is mainly expressed in the immune system regulating its functions, and is upregulated in response to tissue stress or damage in most cell types. The ECS is therefore involved in pathophysiological conditions in both the central and peripheral tissues.

The actions of endogenous ligands can be enhanced or attenuated by targeting mechanisms that are associated with their transport within the cellular and extra cellular matrix as well as their synthesis and breakdown. Small molecule chemical modulators of the ECS can be derived from the cannabis plant ( phytocannabinoids ), can be semi-synthetic derivatives of phytocannabinoids or endocannabinoids, or can be completely synthetic new chemical entities. We plan to develop approaches within our portfolio that address receptor binding and endocannabinoid transport modulation using only synthetic new chemical entities. Future approaches may also involve targeting synthesis or breakdown enzymes.

ECS targeting cannabinoid-based medicines are already approved and used to treat numerous medical conditions. The ECS is further implicated in many disease states within the peer reviewed literature including conditions which involve the regulation of food intake, central nervous system, pain, cardiovascular, gastrointestinal, immune and inflammation, behavioral, antiproliferative and reproductive functions. These areas of ECS pathophysiology are aligned with our therapeutic areas of focus: pain, inflammation, anorexia, cardiovascular, and cancer. | |||

| 2 |

|

|

| Table of Contents |

|

|

| Business Strategy

Our objective is to develop and commercialize ethical pharmaceutical products that provide physicians access to the therapeutic potential of cannabinoid therapeutics and other modulators of the ECS for their patients. We intend to pursue technologies and compounds that offer promising therapeutic approaches to cannabinoid-based therapies, including mimetics of naturally-occurring cannabinoids and fully synthetic cannabinoids, as well as compounds that promote the effectiveness of the ECS.

Risks Associated with our Business

Our ability to execute our business strategy is subject to numerous risks, as more fully described in the section captioned “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock and warrants. In particular, risks associated with our business include, but are not limited to, the following: | ||

|

| · | we will need to raise additional financing to support our business objectives. We cannot be sure we will be able to obtain additional financing on terms favorable to us when needed, or at all. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated; |

|

| · | if we fail to comply with our obligations under our patent licenses with third parties, we could lose license rights that are vital to our business; |

|

| · | we face many of the risks and difficulties frequently encountered by relatively new companies with respect to our operations; |

|

| · | we do not have any therapeutic products that are approved for commercial sale. Our ability to generate revenue from product sales and become profitable depends significantly on our success in a number of factors; |

|

| · | we have no mature product candidates and may not be successful in licensing any; |

|

| · | we may face potential unforeseen business disruptions or market fluctuations that delay our product development or clinical trials and increase our costs or expenses, such as business or operational disruptions, delays, or system failures due to malware, unauthorized access, terrorism, war, natural disasters, strikes, geopolitical conflicts, restrictions on trade, import or export restrictions, or public health crises, such as the current COVID-19 outbreak; |

|

| · | we have very limited operating history and capabilities; |

|

| · | if we are unable to obtain and maintain patent protection for our products, our competitors could develop and commercialize products and technology similar or identical to our product candidates, and our ability to successfully commercialize any product candidates we may develop, and our science may be adversely affected; |

|

| · | obtaining and maintaining our patent protection depends on compliance with various procedural measures, document submissions, fee payments and other requirements imposed by government patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements; |

|

| · | we may be subject to claims challenging the inventorship of our patents and other intellectual property; |

|

| · | intellectual property litigation could cause us to spend substantial resources and distract our personnel from their normal responsibilities; |

|

| · | our executive officers and certain stockholders possess the majority of our voting power, and through this ownership, control the Company and our corporate actions; |

|

| · | shares of our common stock that have not been registered under federal securities laws are subject to resale restrictions imposed by Rule 144, including those set forth in Rule 144(i) which apply to a former “shell company;” and |

|

| · | the common stock issuable upon the exercise of the Public Warrants and Underwriter’s Warrants are speculative. |

|

| ||

| 3 |

|

|

| Table of Contents |

| Reverse Stock Split

On June 20, 2019, we implemented a 1-for-8 reverse stock split of our authorized and issued and outstanding shares of common stock. The share and per share information in this prospectus, other than in our Financial Statements and the Notes thereto, reflects such reverse stock split.

Corporate and other Information

We were incorporated in the State of Nevada on May 2, 2011 as Knight Knox Development Corp. On January 19, 2017 we changed our name to Reactive Medical, Inc. and on April 14, 2017 we changed our name to Artelo Biosciences, Inc. Our principal executive offices are located at 888 Prospect Street, Suite 210, La Jolla, California 92037 and our telephone number is (760) 943-1689. Our corporate website address is www.artelobio.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

Implications of being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ||

|

| · | being permitted to present only two years of audited financial statements and only two years of “Selected Financial Data” and related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; |

|

| · | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

|

| · | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

|

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

|

We may use these provisions until the last day of our fiscal year ending August 2020. However, if certain events occur prior to the end of such period, including if we become a “large accelerated filer,” our annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies. We have elected to avail ourselves of this exemption and, therefore, we are not subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. | ||

| 4 |

|

|

| Table of Contents |

| THE OFFERING | ||

|

| ||

| Securities offered by Artelo |

| (i) 1,491,915 shares of Common Stock issuable upon the exercise of the Public Warrants. The Public Warrants will have an exercise price of $6.4575 per share, and will expire on June 25, 2024 and (ii) 104,065 shares of common Stock issuable upon the exercise of the Underwriter’s Warrants. The Underwriter’s Warrants have an exercise price of $6.765 per share. |

|

| ||

| Common stock offered by Artelo |

| 1,595,980 shares |

|

| ||

| Common stock outstanding after this offering |

| 5,023,379 shares |

|

| ||

| Use of proceeds |

| In order to obtain the shares of common stock underlying the Public Warrants and/or the Underwriter’s Warrants, the holders thereof must pay the applicable exercise price. We will receive proceeds from any exercises of the Public Warrants and the Underwriter’s Warrants, but not from the sale of the underlying common stock. We currently expect to use the net proceeds from this offering to advance our product candidates in the context of general corporate purposes, including manufacturing, research and technical development, clinical studies, capital expenditures, and working capital. We may also use our net proceeds to acquire and invest in complementary products, technologies or businesses; however, we currently have no agreements or commitments to complete any such transaction and are not involved in negotiations to do so. Pending these uses, we intend to invest our net proceeds from this offering primarily in investment-grade, interest-bearing instruments. See “Use of Proceeds” on page 38. |

| 5 |

|

|

| Table of Contents |

| Risk Factors |

| You should carefully read the “Risk Factors” section of this prospectus beginning on page 9 for a discussion of factors that you should consider before deciding to invest in our common stock. | ||

|

| ||||

| Nasdaq Capital Market Trading Symbol and Listing |

| Our Common Stock is listed on the Nasdaq Capital Market under the symbol “ARTL” and our Public Warrants are listed under the symbol “ARTLW.” | ||

|

| ||||

| The table and discussion above are based on 5,023,379 shares of common stock outstanding as of March 20, 2020, and excludes the following: | ||||

|

| • | 281,834 shares of our common stock issuable upon the exercise of options or restricted stock awards granted under our 2018 Equity Incentive Plan (the “2018 Plan”), with a weighted-average exercise price of $3.57 per share; | ||

|

| • | 738,957 shares of our common stock issuable upon the exercise of warrants issued before June 20, 2019, with a weighted-average exercise price of $11.67 per share; and | ||

|

| • | 93,166 shares of our common stock reserved for future issuance under our 2018 Plan. | ||

|

| Unless otherwise noted, the information in this prospectus assumes: | |||

|

| • | no exercise of outstanding options or warrants subsequent to March 20, 2020. | ||

| 6 |

|

|

| Table of Contents |

| SUMMARY FINANCIAL DATA*

The following tables summarize our financial data for the periods and as of the dates indicated. We have derived the statements of operations data for the years ended August 31, 2019 and 2018 from our audited financial statements included elsewhere in this prospectus. We have derived the statements of operations data for the three months ended November 30, 2019 and 2018, and the balance sheet data as of November 30, 2019 from our unaudited interim financial statements included elsewhere in this prospectus. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future and the results for the three months ended November 30, 2019 are not necessarily indicative of the results that may be expected for the full year or any other period. You should read this information together with our financial statements and related notes appearing elsewhere in this prospectus and the information in the section titled Management s Discussion and Analysis of Financial Condition and Results of Operations.

| ||||||||

|

|

| Three months ended |

| |||||

|

|

| November 30, |

| |||||

|

|

| 2019 |

|

| 2018 |

| ||

|

|

| (Unaudited) |

| |||||

| OPERATING EXPENSES |

|

|

|

|

|

| ||

| General and administrative |

| $ | 403,159 |

|

| $ | 205,501 |

|

| Professional fees |

|

| 266,227 |

|

|

| 167,293 |

|

| Research and development |

|

| 666,938 |

|

|

| 184,039 |

|

| Depreciation |

|

| 124 |

|

|

| 70 |

|

| Total Operating Expenses |

|

| 1,336,448 |

|

|

| 556,903 |

|

|

|

|

|

|

|

|

|

|

|

| Loss from Operations |

|

| (1,336,448 | ) |

|

| (556,903 | ) |

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

| Other income |

|

| 586 |

|

|

| - |

|

| Change in fair value of derivative liabilities |

|

| 29,501 |

|

|

| - |

|

| Total other income |

|

| 30,087 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

| (1,306,361 | ) |

| $ | (556,903 | ) |

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

| 16,344 |

|

|

| 4,888 |

|

| Total Other Comprehensive Income (Loss) |

|

| 16,344 |

|

|

| 4,888 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMPREHENSIVE LOSS |

| $ | (1,290,017 | ) |

| $ | (552,015 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic Loss per Common Share |

| $ | (0.39 | ) |

| $ | (0.32 | ) |

| Diluted Loss per Common Share |

| $ | (0.40 | ) |

| $ | (0.32 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic Weighted Average Common Shares Outstanding |

|

| 3,361,601 |

|

|

| 1,754,494 |

|

| Diluted Weighted Average Common Shares Outstanding |

|

| 3,379,000 |

|

|

| 1,754,494 |

|

|

| ||||||||

| 7 |

|

|

| Table of Contents |

|

|

|

|

| |||||

|

|

| Year ended |

| |||||

|

|

| August 31, |

| |||||

|

|

| 2019 |

|

| 2018 |

| ||

|

|

|

|

|

|

|

| ||

| OPERATING EXPENSES |

|

|

|

|

|

| ||

| General and administrative |

| $ | 952,334 |

|

| $ | 508,278 |

|

| Professional fees |

|

| 1,164,695 |

|

|

| 585,069 |

|

| Research and development |

|

| 1,091,992 |

|

|

| 1,249,854 |

|

| Depreciation |

|

| 510 |

|

|

| 290 |

|

| Total Operating Expenses |

|

| 3,209,531 |

|

|

| 2,343,491 |

|

|

|

|

|

|

|

|

|

|

|

| Loss from Operations |

|

| (3,209,531 | ) |

|

| (2,343,491 | ) |

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

| Other income |

|

| 31,256 |

|

|

| - |

|

| Change in fair value of derivative liabilities |

|

| 1,006,099 |

|

|

| - |

|

| Total other income |

|

| 1,037,355 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

| (2,172,176 | ) |

| $ | (2,343,491 | ) |

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

| 2,474 |

|

|

| (12,937 | ) |

| Total Other Comprehensive Income Loss |

|

| 2,474 |

|

|

| (12,937 | ) |

|

|

|

|

|

|

|

|

|

|

| TOTAL COMPREHENSIVE LOSS |

| $ | (2,169,702 | ) |

| $ | (2,356,428 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic Loss per Common Share |

| $ | (1.00 | ) |

| $ | (1.84 | ) |

| Diluted Loss per Common Share |

| $ | (1.46 | ) |

| $ | (1.84 | ) |

|

|

|

|

|

|

|

|

|

|

| Basic Weighted Average Common Shares Outstanding |

|

| 2,172,465 |

|

|

| 1,277,527 |

|

| Diluted Weighted Average Common Shares Outstanding |

|

| 2,172,465 |

|

|

| 1,277,527 |

|

|

|

|

|

| |||||||||

|

|

| As of |

| |||||||||

|

|

| November 30, |

|

| August 31, |

|

| August 31, |

| |||

|

|

| 2019 |

|

| 2019 |

|

| 2018 |

| |||

| Balance Sheet Data: |

| (Unaudited) |

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

| |||

| Cash and cash equivalents |

| $ | 3,374,683 |

|

| $ | 4,423,965 |

|

| $ | 337,424 |

|

| Working capital (deficiency) |

|

| 2,923,349 |

|

|

| 3,421,075 |

|

|

| (135,537 | ) |

| Total assets |

|

| 5,547,918 |

|

|

| 6,482,726 |

|

|

| 396,998 |

|

| Total liabilities |

|

| 584,554 |

|

|

| 1,021,513 |

|

|

| 531,972 |

|

| Additional paid-in capital |

|

| 11,070,517 |

|

|

| 10,278,421 |

|

|

| 2,514,136 |

|

| Accumulated deficit |

|

| (6,117,117 | ) |

|

| (4,810,756 | ) |

|

| (2,638,580 | ) |

| Accumulated other comprehensive income (loss) |

|

| 6,538 |

|

|

| (9,806 | ) |

|

| (12,280 | ) |

| Total stockholders’ equity (deficit) |

| $ | 4,963,364 |

|

| $ | 5,461,213 |

|

| $ | (134,974 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8 |

|

|

| Table of Contents |

RISK FACTORS

Before you invest in our securities, you should be aware that our business faces numerous financial and market risks, including those described below, as well as general economic and business risks. Our securities are speculative, and you should not make an investment in Artelo unless you can afford to bear the loss of your entire investment. The following discussion provides information concerning the material risks and uncertainties that we have identified and believe may adversely affect our business, our financial condition and ability to continue as a going concern, and our results of operations. Before you decide whether to invest in our securities, you should carefully consider these risks and uncertainties, together with all of the other information included in or incorporated by reference into this prospectus. The risks and uncertainties identified below are not the only risks and uncertainties we face. If any of the risks or uncertainties that we face materialize, you could lose part or all of your investment.

RISKS RELATED TO OUR BUSINESS AND PRODUCT CANDIDATES

Our ability to continue our operations requires that we raise additional capital and our operations could be curtailed if we are unable to obtain the additional funding as or when needed.

Upon the completion of our financial statements for the period ended November 30, 2019, and management’s assessment of our ability to continue as a going concern, we concluded there was substantial doubt about our ability to continue as a going concern for the twelve months after the date of this report. Our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year-ended August 31, 2019, noting the existence of substantial doubt about our ability to continue as a going concern. As of the date of this report, there have been no changes to management’s conclusion that there remains substantial doubt about our ability to continue as a going concern.

To continue to fund operations, we will need to secure additional funding. We may obtain additional financing in the future through the issuance of our common stock, through other equity or debt financings or through collaborations or partnerships with other companies. We may not be able to raise additional capital on terms acceptable to us, or at all. Further, any failure to raise capital as and when needed could compromise our ability to execute on our business plan, and we may be forced to liquidate our assets. In such a scenario, the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements.

We will need to raise additional financing to support our business objectives. We cannot be sure we will be able to obtain additional financing on terms favorable to us when needed, or at all. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated.

Since our inception, we have used substantial amounts of cash to fund our operations and expect our expenses to increase substantially in the foreseeable future. Developing our product candidates and conducting clinical trials in the future will require substantial amounts of capital. We will also require a significant additional amount of capital to commercialize any products that are approved in the future.

We will need to raise significant additional capital in the future to pursue our business objectives. Our current financial resources are limited. We will need to raise additional funds in the near future in order to satisfy our working capital and capital expenditure requirements. We may raise additional funds through public or private equity offerings, debt financings, strategic partnerships or alliances, receivables or royalty financings or corporate collaboration and licensing arrangements. We cannot be certain that additional funding will be available on acceptable terms, or at all. To the extent that we raise additional capital by issuing equity securities or convertible debt, your ownership will be diluted and the terms of such financings may include liquidation or other preferences that adversely affect the rights of existing stockholders. Any future debt financing into which we enter may impose upon us covenants that restrict our operations, including limitations on our ability to incur liens or additional debt, pay dividends, redeem our stock, make certain investments and engage in certain merger, consolidation or asset sale transactions. These restrictions could adversely impact our ability to conduct our business and may result in liens being placed on our assets and intellectual property. Debt financings may also be coupled with an equity component, such as warrants to purchase shares, which could also result in dilution of our existing stockholders’ ownership. The incurrence of indebtedness would result in increased fixed payment obligations and could also result in certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business and may result in liens being placed on our assets and intellectual property. If we were to default on such indebtedness, we could lose such assets and intellectual property. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our product candidates. In addition, if we raise additional funds through corporate collaboration and licensing arrangements, it may be necessary to relinquish potentially valuable rights to products or product candidates, or grant licenses on terms that are not favorable to us. Our future capital requirements may depend on a wide range of factors, including, but not limited to:

| 9 |

|

|

| Table of Contents |

| · | the costs related to initiation, progress, timing, costs and results of preclinical studies and clinical trials for our product candidates; | |

|

| ||

| · | any change in the clinical development plans for these product candidates; | |

|

| ||

| · | the number and characteristics of product candidates that we develop or acquire; | |

|

| ||

| · | our ability to establish and maintain strategic collaborations, licensing or other commercialization arrangements and the terms and timing of such arrangements; | |

|

| ||

| · | the emergence, approval, availability, perceived advantages, relative cost, relative safety and relative efficacy of other products or treatments; | |

|

| ||

| · | the events related to the outcome, timing and cost of meeting regulatory requirements established by the U.S. Drug Enforcement Agency (the “DEA”), the FDA or other comparable foreign regulatory authorities; | |

|

| ||

| · | the potential costs of filing, prosecuting, defending and enforcing our patent claims and other intellectual property; | |

|

| ||

| · | the expenses needed to attract and retain skilled personnel; | |

|

| ||

| · | the costs associated with being a public company; | |

|

| ||

| · | the cost of defending intellectual property disputes; and | |

|

| ||

| · | the cost of marketing and generating revenues for any of our product candidates. |

If we are unable to raise additional capital when required or on acceptable terms, we may be required to significantly delay, scale back or discontinue one or more of our product development programs or commercialization efforts, or other aspects of our business plan. We also may be required to relinquish, license or otherwise dispose of rights to products or product candidates that we would otherwise seek to commercialize or develop ourselves on terms that are less favorable than might otherwise be available. In addition, our ability to achieve profitability or to respond to competitive pressures would be significantly limited.

If we fail to comply with our obligations under our patent licenses with third parties, we could lose license rights that are vital to our business.

We are a party to license agreements with NEOMED Institute, a Canadian not-for-profit corporation, renamed adMare in June 2019 (“NEOMED”) and the Research Foundation at Stony Brook University, pursuant to which we in-license key patents and patent applications for our product candidates. These existing licenses impose various diligence, milestone payment, royalty and other obligations on us. If we fail to comply with these obligations, our licensors may have the right to terminate the licenses, in which event we would not be able to develop or market the products covered by such licensed intellectual property. In particular, on April 24, 2019, we exercised our option (the “Option Exercise”) pursuant to the Material and Data Transfer, Option and License Agreement with NEOMED dated as of December 20, 2017, as amended on January 4, 2019 (the “NEOMED Agreement”). If we are found in the future not to be in compliance with the NEOMED Agreement, our license agreement with the Research Foundation at Stony Brook University (the “Stony Brook Agreement”), or any other license agreements it could materially adversely affect our business, results of operations, financial condition and prospects. If we fail to comply with these any of our license obligations, our licensors may have the right to terminate these agreements, in which event we might not be able to develop and market any product candidate that is covered by these agreements. Termination of these licenses or reduction or elimination of our licensed rights may result in our having to negotiate new or reinstated licenses with less favorable terms. We may enter into additional licenses in the future and if we fail to comply with obligations under those agreements, we could suffer similar consequences.

| 10 |

|

|

| Table of Contents |

Changes in regulatory requirements or other unforeseen circumstances may impact the timing of the initiation or completion of our clinical trials.

Changes in regulatory requirements and guidance may occur, and we may need to amend clinical trial protocols or our development plan to reflect these changes. Amendments may require resubmitting clinical trial protocols to the FDA or other similar authorities in other jurisdictions and institutional review boards for reexamination, which may impact the costs, timing or successful completion of our clinical trials. If we experience delays in completion of, or if we terminate any planned clinical trials, the commercial prospects for product candidates may be harmed, and the ability to generate product revenues will be delayed. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of product candidates.

The full impact of the COVID-19 pandemic on Artelo’s clinical trial plans, product development, and how the a regulatory body reviews study data has been significantly impacted by the pandemic, is difficult to predict, but may have a material adverse impact on Artelo’s business operations, clinical trial plans, and product development, including delays in clinical trial and study participant recruitment, delay in regulatory approval of our product candidates, and additional costs and resources. The pandemic’s impact on the economy and drug product manufacturing and supply chain may also adversely affect Artelo’s clinical trial plans and drug development. Additionally, depending on the duration of shelter-in-place, social distancing, and similar measures, as well as business closures and stresses on our healthcare systems and clinical trial sites, Artelo’s ability to recruit participants for its clinical trials may be significantly impacted. Artelo may not be able to commence or complete its clinical trials as currently planned. Artelo may be required to significantly modify its study protocol, policies and procedures in order to address or accommodate patients and study site needs during the pandemic or some time after the immediate concerns have been reduced. Such changes can include modification to protocol inclusion and exclusion criteria, extending the time for patient follow up visits, using telemedicine, phone interviews and other technology to monitor patient safety, all of which will need to be approved.

We face many of the risks and difficulties frequently encountered by relatively new companies with respect to our operations.

Our business objective is to pursue the licensing, development and commercialization of therapeutic treatments that are associated with modulation of the endocannabinoid system. We have limited operating history as a medical research company engaged in biopharmaceutical research upon which an evaluation of our Company and our prospects could be based. There can be no assurance that our management will be successful in being able to commercially exploit the results, if any, from our product development research projects or that we will be able to develop products and treatments that will enable us to generate sufficient revenues to meet our expenses or to achieve and/or maintain profitability.

If we are unable to raise sufficient capital as needed, we may be required to reduce the scope of our planned research and development activities, which could harm our business plans, financial condition and operating results, or cease our operations entirely, in which case, you will lose all your investment.

Even if one or more of our product candidates is approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product candidate and we may not generate significant revenue from sales of such products, resulting in limited or no profitability in the future. Our prior losses and expected future losses have had and will continue to have an adverse effect on our stockholders’ equity and working capital for the foreseeable future. Any failure to become and remain profitable may adversely affect the market price of our securities, our ability to raise capital and our future viability.

We have no mature product candidates and may not be successful in licensing any.

One of the key elements of our business strategy is to license technologies or compounds from companies and/or research institutions. We may not be able to identify technologies or compounds that are commercially viable, or that are available for licensure under acceptable terms. If we are able to identify suitable technologies or compounds, we may be unable to successfully negotiate a license, or maintain the licensing and collaboration arrangements necessary to develop and commercialize any product candidates. We may be unable to compete with companies that are more established than us and have greater financial resources than us for licenses to available technologies and compounds. Even if we are successful in licensing programs, we may not be able to satisfy development requirements should we be unable to raise additional funding.

Any failure to establish or maintain licensing or collaboration arrangements on favorable terms could adversely affect our ability to develop and commercialize product candidates, which can adversely affect our business prospects and financial condition.

Even if we are successful in licensing lead product candidates, resource limitations may limit our ability to successfully develop them.

Pharmaceutical development requires substantial capital, skilled personnel and infrastructure to successfully develop products for the market. The success of our business is highly dependent on our ability to successfully develop, obtain regulatory approval for and commercialize products. We do not currently have the financial resources to fund the development of any lead product candidate and there is no assurance that we can raise enough capital to fund product development. If we are unable to raise additional capital, we will not be able to pursue the development of any products and may have to relinquish rights to any products we may have licensed.

| 11 |

|

|

| Table of Contents |

We do not have any therapeutic products that are approved for commercial sale. Our ability to generate revenue from product sales and become profitable depends significantly on our success in a number of factors.

We currently do not have any therapeutic products that are approved for commercial sale. We have not received, and do not expect to receive for at least the next several years, if at all, any revenues from the commercialization of our product candidates if approved. To obtain revenues from sales of our product candidates that are significant or large enough to achieve profitability, we must succeed, either alone or with third parties, in developing, obtaining regulatory approval for, manufacturing and marketing therapies with commercial potential. Our ability to generate revenue and achieve profitability depends significantly on our success in many areas, including:

| · | our research and development efforts, including preclinical studies and clinical trials of our product candidates; | |

| · | developing sustainable, scalable, reliable and cost-effective manufacturing and distribution processes for our product candidates, including establishing and maintaining commercially viable supply relationships with third parties and establishing our own current good manufacturing processes ( cGMPs ), manufacturing facilities and processes; | |

| · | addressing any competing technological and industry developments; | |

| · | identifying, assessing, acquiring and/or developing new technology platforms and product candidates across numerous therapeutic areas; | |

| · | obtaining regulatory approvals and marketing authorizations for product candidates; | |

| · | launching and commercializing any approved products, either directly or with a collaborator or distributor; | |

| · | obtaining market acceptance of and acceptable reimbursement for any approved products; | |

| · | completing collaborations, licenses and other strategic transactions on favorable terms, if at all; | |

| · | maintaining, protecting and expanding our portfolio of intellectual property rights, including patents, trade secrets and know-how; and | |

| · | attracting, hiring and retaining qualified personnel. |

We have very limited operating history and capabilities.

Although our business was formed in 2011, we have had very limited operations in our current field of interest. We do not currently have the ability to perform the functions necessary to develop any product candidates. The successful development of any product candidates will require us to perform a variety of functions including, but not limited to:

| · | Identifying, licensing and obtaining development programs and lead candidates; | |

| · | Conducting initial research required to identify a lead candidate as the result of intellectual property we have licensed; | |

| · | Initiating preclinical, clinical or other required studies for future product candidates; | |

| · | Adding manufacturers and suppliers required to advance our programs; | |

| · | Obtaining regulatory and marketing approvals for our product candidates that successfully complete clinical studies; | |

| · | Making milestone or other payments under any license agreements; | |

| · | Expanding, maintaining and protecting our intellectual property portfolio; | |

| · | Attracting and retaining skilled personnel; and | |

| · | Creating and maintaining an infrastructure required to support our operations as a public company. |

| 12 |

|

|

| Table of Contents |

Our operations continue to be focused on acquiring, developing and securing our proprietary technology and undertaking preclinical and clinical trials of our products.

We expect our financial condition and operating results to continue to fluctuate from quarter to quarter and year to year due to a variety of factors, many of which are beyond our control. We will need to transition from a company with a research and development focus to a company capable of undertaking commercial activities. We may encounter unforeseen expenses, difficulties, complications and delays and may not be successful in such a transition.

Artelo’s operations and financial results could be adversely impacted by the 2019 Novel Coronavirus (COVID-19) outbreak in China and the rest of the world.

In December 2019, a novel strain of coronavirus (COVID-19) was reported to have surfaced in Wuhan, China, resulting in significant disruptions to manufacturing, supply chain, markets, and travel world-wide, especially businesses involving activities or operations in China. While the extent of the impact of the current COVID-19 coronavirus outbreak on our business and financial results is uncertain, a continued and prolonged public health crisis such as the COVID-19 coronavirus outbreak could have a negative impact on its business, financial condition and operating results. Due to the global pandemic, our clinical trial recruiting and participants could also be slowed or delayed, or in a more severe scenario, our business, financial condition and operating results could be more severely affected. Given the dynamic nature of these circumstances, the duration of any business disruption or potential impact to our business resulting from the COVID-19 coronavirus is difficult to predict, but it may increase our costs or expenses.

We may not be able to file Investigational New Drug applications to commence additional clinical trials on the timelines we expect, and even if we are able to, the FDA may not permit us to proceed in a timely manner, or at all.

Prior to commencing clinical trials in the United States for any of our product candidates, we may be required to have an Investigational New Drug application (“IND”) for each product candidate. Submission of an IND may not result in the FDA allowing clinical trials to begin and, once begun, issues may arise that will require us to suspend or terminate such clinical trials. Additionally, even if relevant regulatory authorities agree with the design and implementation of the clinical trials set forth in an IND or clinical trial application, these regulatory authorities may change their requirements in the future. The fact that we are pursuing novel technologies may also exacerbate these risks with respect to our product candidates, and as a result we may not meet our anticipated clinical development timelines.

Use of our product candidates could be associated with side effects or adverse events.

As with most biopharmaceutical products, use of our product candidates could be associated with side effects or adverse events which can vary in severity and frequency. Side effects or adverse events associated with the use of our product candidates may be observed at any time, including in clinical trials or once a product is commercialized, and any such side effects or adverse events may negatively affect our ability to obtain regulatory approval or market our product candidates. Side effects such as toxicity or other safety issues associated with the use of our product candidates could require us to perform additional studies or halt development or sale of these product candidates or expose us to product liability lawsuits which will harm our business. We may be required by regulatory agencies to conduct additional preclinical or clinical trials regarding the safety and efficacy of our product candidates which we have not planned or anticipated. We cannot assure you that we will resolve any issues related to any product-related adverse events to the satisfaction of the FDA or any regulatory agency in a timely manner or ever, which could harm our business, prospects and financial condition. We may also inadvertently fail to report adverse events we become aware of within the prescribed timeframe. We may also fail to appreciate that we have become aware of a reportable adverse event, especially if it is not reported to us as an adverse event or if it is an adverse event that is unexpected or removed in time from the use of our products. If we fail to comply with our reporting obligations, the FDA or other foreign regulatory agencies could take action including criminal prosecution, the imposition of civil monetary penalties, seizure of our products, or delay in approval or clearance of future products.

Clinical drug development involves a lengthy and expensive process with an uncertain outcome, results of earlier studies and clinical trials may not be predictive of future clinical trial results, and our clinical trials may fail to adequately demonstrate substantial evidence of safety and efficacy of our product candidates.

Clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. A failure of one or more of our clinical trials can occur at any time during the clinical trial process. The results of preclinical studies and early clinical trials of our product candidates may not be predictive of the results of later-stage clinical trials. There is a high failure rate for drugs proceeding through clinical trials, and product candidates in later stages of clinical trials may fail to show the required safety and efficacy despite having progressed through preclinical studies and initial clinical trials. A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier clinical trials, and we cannot be certain that we will not face similar setbacks. Even if our clinical trials are completed, the results may not be sufficient to support obtaining regulatory approval for our product candidates.

| 13 |

|

|

| Table of Contents |

We do not know whether future clinical trials, if any, will begin on time, need to be redesigned, enroll an adequate number of patients on time or be completed on schedule, if at all. Clinical trials can be delayed, suspended or terminated by us, regulatory authorities, clinical trial investigators, and ethics committees for a variety of reasons, including failure to:

| · | generate sufficient preclinical, toxicology, or other in vivo or in vitro data to support the initiation or continuation of clinical trials; | |

| · | obtain regulatory approval, or feedback on clinical trial design, to commence a clinical trial; | |

| · | identify, recruit and train suitable clinical investigators; | |

| · | reach agreement on acceptable terms with prospective clinical research organizations (“CROs”) and clinical trial sites; | |

| · | obtain and maintain institutional review board (“IRB”), approval at each clinical trial site; | |

| · | identify, recruit and enroll suitable patients to participate in a clinical trial; | |

| · | have a sufficient number of patients complete a clinical trial or return for post-treatment follow-up; | |

| · | ensure clinical investigators observe clinical trial protocol or continue to participate in a clinical trial; | |

| · | address any patient safety concerns that arise during the course of a clinical trial; | |

| · | address any conflicts with new or existing laws or regulations; | |

| · | add a sufficient number of clinical trial sites; | |

| · | timely manufacture sufficient quantities of a product candidate for use in clinical trials; or | |

| · | raise sufficient capital to fund a clinical trial. |

Patient enrollment is a significant factor in the timing of clinical trials and is affected by many factors, including the size and nature of the patient population, the proximity of patients to clinical sites, the eligibility criteria for the clinical trial, the design of the clinical trial, competing clinical trials and clinicians’ and patients’ or caregivers’ perceptions as to the potential advantages of the drug candidate being studied in relation to other available therapies, including any new drugs or treatments that may be approved for the indications we are investigating.

We could also encounter delays if a clinical trial is suspended or terminated by us, by the data safety monitoring board for such clinical trial or by the FDA or any other regulatory authority, or if the IRBs of the institutions in which such clinical trials are being conducted suspend or terminate the participation of their clinical investigators and sites subject to their review. Such authorities may suspend or terminate a clinical trial due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements, including good clinical practices (“GCPs”), or our clinical protocols, inspection of the clinical trial operations or clinical trial site by the FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a product candidate, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial.

If we experience delays in the completion of, or termination of, any clinical trial of our product candidates for any reason, the commercial prospects of our product candidates may be harmed, and our ability to generate product revenues from any of these product candidates will be delayed. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval process and jeopardize our ability to commence product sales and generate revenues. Any of these occurrences may significantly harm our business, financial condition and prospects. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

| 14 |

|

|

| Table of Contents |

Due to our limited resources, we may be forced to focus on a limited number of development candidates which may force us to pass on opportunities that could have a greater chance of clinical success.

Due to our limited resources and capabilities, we will have to decide to focus on developing a limited number of product candidates. As a result, we may forego or delay pursuit of opportunities with other product candidates or for other indications that later prove to have greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial product candidates or profitable market opportunities. Our spending on research and development programs and product candidates for specific indications may not yield any commercially viable products. If we do not accurately evaluate the commercial potential or target market for a particular product candidate, we may relinquish valuable rights to that product candidate through collaboration, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product candidate.

We will need to rely on third parties to conduct our preclinical research and clinical trials and those third parties may not perform satisfactorily, including failing to meet deadlines for the completion of such research or trials.

We plan to rely on third-party CROs, to conduct the majority of our preclinical research studies and our clinical trials. In addition, we plan to rely on other third parties, such as clinical data management organizations, medical institutions and clinical investigators, to conduct those clinical trials. There is no assurance we can obtain the services we need at commercially reasonable prices or within the timeframes we desire. Even though we will enter into agreements governing their activities, we will have limited influence over their actual performance and we will control only certain aspects of their activities. Further, agreements with such third parties might terminate for a variety of reasons, including a failure to perform by the CROs. If there is any dispute or disruption in our relationship with our contractors or if we need to enter into alternative arrangements, that would delay our product development activities.

Our reliance on third parties for research and development activities will reduce our control over these activities, and will not relieve us of our responsibilities. For example, we will remain responsible for ensuring that each of our clinical trials is conducted in accordance with the general investigational plan and protocols for the trial. If any of our CROs’ processes, methodologies or results were determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals could be adversely affected. Moreover, the FDA requires us to comply with GCPs for conducting, recording and reporting the results of clinical trials to assure that data and reported results are credible and accurate and that the rights, integrity and confidentiality of trial participants are protected. The FDA enforces these GCPs through periodic inspections of trial sponsors, principal investigators and clinical trial sites. If we or our CRO fail to comply with applicable GCPs, the clinical data generated in our clinical trials may be deemed unreliable and the FDA may require us to perform additional clinical trials before approving any marketing applications. Upon inspection, the FDA may determine that our clinical trials did not comply with GCPs. In addition, our clinical trials will require a sufficiently large number of test subjects to evaluate the safety and effectiveness of a product candidate. Accordingly, if our CROs fail to comply with these regulations or fail to recruit a sufficient number of patients, our clinical trials may be delayed or we may be required to repeat such clinical trials, which would delay the regulatory approval process.

Furthermore, these third parties may also have relationships with other entities, some of which may be our competitors. If these third parties do not successfully carry out their contractual duties, meet expected deadlines, or if the quality of the clinical data they obtain is compromised due to the failure to conduct our clinical trials in accordance with regulatory requirements or our stated protocols, we will not be able to obtain, or may be delayed in obtaining, marketing approvals for our product candidates and will not be able to, or may be delayed in our efforts to, successfully commercialize our product candidates.

A coronavirus pandemic is ongoing in many parts of the world and can result in significant disruptions to our supply of the investigational product for our clinical trials which could have a material adverse effect on our business.

As the COVID-19 pandemic is still evolving as of this time, much of its impact remains unknown, and it is impossible to predict the impact it may have on the development of Artelo’s product candidates and the impact on its business. The severity of the coronavirus pandemic could also make access to our existing supply chain difficult or impossible by delaying the delivery of key raw materials used in its product candidates and therefore delay the delivery of such products for use in its clinical trials. Any of these results could materially impact Artelo’s business and have an adverse effect on our business.

| 15 |

|

|

| Table of Contents |

We currently have no marketing and sales organization and have no experience in marketing products. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to generate product revenue.

We currently have no sales, marketing or distribution capabilities and have no experience as a company in marketing products. If we develop internal sales, marketing and distribution organization, this would require significant capital expenditures, management resources and time, and we would have to compete with other pharmaceutical and biotechnology companies to recruit, hire, train and retain marketing and sales personnel.