UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

|

|

|

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

|

|

|

| ☒ | Definitive Proxy Statement |

|

|

|

| ☐ | Definitive Additional Materials |

|

|

|

| ☐ | Soliciting Material Pursuant to §240.14a‑11(c) or §240.14a‑2 |

| ARTELO BIOSCIENCES, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

|

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

|

|

|

| ☒ | No fee required. |

|

|

|

| ☐ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(4) and 0‑11. |

|

| (1) | Title of each class of securities to which transaction applies: |

|

|

|

|

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

|

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

| (4) | Proposed maximum aggregate value of transaction: |

|

|

|

|

|

| (5) | Total fee paid: |

|

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

|

|

|

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| (1) | Amount Previously Paid: |

|

|

|

|

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

|

|

|

| (3) | Filing Party: |

|

|

|

|

|

| (4) | Date Filed: |

|

|

|

|

888 Prospect Street, Suite 210

La Jolla, CA 92037

November 9, 2020

To our Stockholders:

We are pleased to invite you to attend a special meeting of stockholders of Artelo Biosciences, Inc. (the “Special Meeting”) to be held on Thursday, December 3, 2020, at 8:00 a.m. U.S. Pacific Time, or any adjournment or postponement thereof to conduct the following items of business:

|

| · | Proposal 1 – To approve an amendment to our Articles of Incorporation, as amended, to increase the number of authorized shares of the Company’s common stock, par value $0.001, (“Common Stock”) from 18,750,000 to 750,000,000; |

|

|

|

|

|

| · | Proposal 2 – To approve an amendment to the 2018 Equity Incentive Plan (the “2018 Plan”), which would increase the number of shares of Common Stock reserved for issuance under the 2018 Plan by 2,000,000 shares and extend the term of the 2018 Plan until October 2030; and |

|

|

|

|

|

| · | Proposal 3 – To authorize one or more adjournments of the Special Meeting to solicit additional proxies in the event there are insufficient votes to approve Proposal 1 and/or Proposal 2 described above. |

Our Board of Directors unanimously recommends that you vote FOR Proposals 1, 2 and 3.

The Special Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Special Meeting online, vote and submit your questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/ARTL2020SM. We are pleased to utilize the virtual stockholder meeting technology (i) to provide ready access and cost savings for our stockholders and the Company and (ii) to promote social distancing pursuant to guidance provided by the Center for Disease Control and the U.S. Securities and Exchange Commission due to the novel coronavirus. The virtual meeting format allows attendance from any location in the world. You will not be able to attend the Special Meeting in person.

Even if you are planning on attending the Special Meeting online, please promptly submit your proxy vote via the Internet, by telephone, or, by mail according to the instructions on the enclosed proxy card or voting instruction card, so your shares will be represented at the Special Meeting. Instructions on voting your shares are on the proxy materials you received for the Special Meeting. Even if you plan to attend the Special Meeting online, it is strongly recommended that you vote before the Special Meeting date via the Internet, by phone, or by mail, to ensure that your shares will be represented at the Special Meeting if you are unable to attend.

Details regarding admission to the meeting and the business to be conducted at the meeting are more fully described in the accompanying Notice of Special Meeting of Stockholders and proxy statement.

Only holders of our common stock at the close of business on October 14, 2020, the record date, are entitled to receive notice of and to attend and vote at the Special Meeting and any adjournment or postponement thereof.

Your vote is important. Whether or not you plan to attend the meeting, please sign and submit your proxy as soon as possible so that your shares can be voted at our Special Meeting in accordance with your instructions. If you attend the meeting, you may revoke your proxy in accordance with the procedures set forth in the proxy statement and vote in person.

| 2 |

Thank you for your continued support of Artelo Biosciences, Inc.

|

|

| Sincerely, |

|

| /s/ Gregory D. Gorgas | |||

|

|

| Gregory D. Gorgas | |

| President and Chief Executive Officer | |||

| La Jolla, California November 9, 2020 |

|

|

|

| 3 |

ARTELO BIOSCIENCES, INC.

888 Prospect Street, Suite 210

La Jolla, CA 92037

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON

THURSDAY, DECEMBER 3, 2020

Notice is hereby given that a special meeting of stockholders will be held on Thursday, December 3, 2020, at 8:00 a.m. U.S. Pacific Time, or any adjournment or postponement thereof, as a virtual meeting at www.virtualshareholdermeeting.com/ARTL2020SM. At the special meeting or any postponement, adjournment or delay thereof (the “Special Meeting”), you will be asked to consider and vote upon the following proposals:

|

| · | Proposal 1 – To approve an amendment to our Articles of Incorporation, as amended, to increase the number of authorized shares of the Company’s common stock, par value $0.001, (“Common Stock”) from 18,750,000 to 750,000,000; |

|

|

|

|

|

| · | Proposal 2 – To approve an amendment to the 2018 Equity Incentive Plan (the “2018 Plan”), which would increase the number of shares of common stock reserved for issuance under the 2018 Plan by 2,000,000 shares and extend the term of the 2018 Plan until October 2030; and |

|

|

|

|

|

| · | Proposal 3 – To authorize one or more adjournments of the special meeting to solicit additional proxies in the event there are insufficient votes to approve Proposal 1 and/or Proposal 2 described above. |

Your attention is directed to the Proxy Statement which is set forth on the following pages, where the foregoing items of business are more fully described. The Board of Directors has fixed the close of business on October 14, 2020 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS.

Your vote is extremely important, regardless of the number of shares you own. Whether or not you plan to attend the Special Meeting, we ask that you promptly sign, date and return the enclosed proxy card or voting instruction card in the envelope provided, or submit your proxy by telephone or over the Internet (if those options are available to you) in accordance with the instructions on the enclosed proxy card or voting instruction card.

YOU ARE RESPECTFULLY REQUESTED BY THE BOARD TO PROMPTLY SIGN, DATE AND RETURN THE ENCLOSED PROXY OR VOTE OVER THE INTERNET OR BY TELEPHONE. IF YOU GRANT A PROXY, YOU MAY REVOKE IT AT ANY TIME PRIOR TO THE MEETING OR VOTE AT THE MEETING. IF YOU RECEIVED THIS PROXY STATEMENT IN THE MAIL, A RETURN ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. THIS WILL NOT PREVENT YOU FROM VOTING AT THE MEETING BUT WILL, HOWEVER, HELP TO ASSURE A QUORUM AND AVOID ADDED PROXY SOLICITATION COSTS.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be Held on December 3, 2020. The proxy statement and the accompanying materials are being mailed on or about November 9, 2020 to all stockholders entitled to vote at the Special Meeting. A copy of our proxy statement is also posted on www.artelobio.com, and is available from the SEC on its website at www.sec.gov.

| By Order of the Board of Directors, | |||

|

|

|

|

|

| By: | /s/ Gregory D. Gorgas | ||

|

|

| Gregory D. Gorgas | |

| President and Chief Executive Officer | |||

| La Jolla, California November 9, 2020 |

| 4 |

ARTELO BIOSCIENCES, INC

|

|

| Page |

| |

|

|

|

|

| |

|

|

| 6 |

| |

|

|

| 11 |

| |

|

|

| 14 |

| |

|

|

| 21 |

| |

|

|

| 23 |

| |

| 5 |

ARTELO BIOSCIENCES, INC.

888 Prospect Street, Suite 210

La Jolla, CA 92037

PROXY STATEMENT FOR

THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON

DECEMBER 3, 2020

The Board of Directors (the “Board”) of Artelo Biosciences, Inc., a Nevada corporation (“Artelo,” “Artelo Biosciences,” “the company,” “we,” “us” or “our”), has delivered this proxy statement and accompanying proxy materials to you in connection with the solicitation of proxies for use at the upcoming Special Meeting of Stockholders (the “Special Meeting”). The Special Meeting will be held live via internet webcast on December 3, 2020 at 8:00 a.m., Pacific Time, or at any adjournment or postponement thereof, for the purposes stated herein. This proxy statement and accompanying proxy materials were first sent or given on November 9, 2020 to all stockholders as of the record date.

Proxy

A proxy is your legal designation of another person to vote the stock you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the enclosed proxy card, or if available, voting by telephone or the Internet. We have designated Gregory D. Gorgas to serve as the proxy for the Special Meeting.

Virtual Special Meeting

We are embracing technology to provide expanded access, improved communication, reduced environmental impact and cost savings for our stockholders and the Company. Hosting a virtual meeting enables increased stockholder attendance and participation since stockholders can participate and ask questions from any location around the world, and provides us an opportunity to give thoughtful responses. In addition, we intend for the virtual meeting format to provide stockholders with a similar level of transparency as the traditional in-person meeting format, and we will take steps to ensure such an experience. Our stockholders will be afforded substantially the same opportunities to participate at the virtual Special Meeting as they would at an in-person special meeting of stockholders.

Participating in the Special Meeting

We will host the Special Meeting live via internet webcast. You will not be able to attend the Special Meeting in person. A summary of the information you need in order to attend the Special Meeting online is provided below:

|

| · | Any stockholder may listen to the Special Meeting and participate live via the internet at www.virtualshareholdermeeting.com/ARTL2020SM. The live internet webcast will begin on Thursday, December 3, 2020 at 8:00 a.m., Pacific Time. |

|

|

|

|

|

| · | Stockholders may vote and submit questions during the Special Meeting live via the internet. |

|

|

|

|

|

| · | To enter the meeting, please have your 16-digit control number available. The 16-digit control number is listed on your proxy card. If you do not have your 16-digit control number, you will be able to listen to the meeting only. You will not be able to vote or submit questions during the meeting. |

|

|

|

|

|

| · | We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Special Meeting log-in page. |

|

|

|

|

|

| · | Instructions regarding how to connect and participate live via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/ARTL2020SM. |

| 6 |

| Table of Contents |

Voting Rights and Outstanding Shares

Only stockholders that owned our common stock at the close of business on October 14, 2020, the record date for the Special Meeting, are entitled to notice of, and to vote at, the Special Meeting. On the record date, 15,111,587 shares of our common stock were outstanding. Each share of our common stock that you own entitles you to one vote on each matter to be voted upon at the Special Meeting. We will have a quorum to conduct the business of the Special Meeting if the holders of a majority of the outstanding shares of our common stock entitled to vote are present, in person via the internet webcast or by proxy. Abstentions and broker non-votes (i.e., shares of common stock held by a broker, bank or other agent that are represented at the meeting, but which the broker, bank or other agent is not empowered to vote on a particular proposal) will be counted for purposes of determining whether a quorum is present at the Special Meeting.

Proposals for the Special Meeting

There are three (3) proposals scheduled to be voted on at the Special Meeting:

|

| · | An amendment of the Company’s Articles of Incorporation to increase the number of authorized shares of the Company’s common stock, par value $0.001, (“Common Stock”) from 18,750,000 to 750,000,000; |

|

|

|

|

|

| · | An amendment to the Company’s 2018 Equity Incentive Plan to increase the number of shares of Common Stock reserved for issuance thereunder by 2,000,000 shares and to extend the term of the plan; and |

|

|

|

|

|

| · | Authorization of one or more adjournments of the special meeting to solicit additional proxies in the event there are insufficient votes to approve Proposal 1 or Proposal 2 above. |

Voting Requirements to Approve Each Proposal

Proposal 1 – Amendment of Articles of Incorporation. The affirmative “FOR” vote of holders of a majority of outstanding shares entitled to vote at the special meeting is required for the approval of the amendment of the Company’s Articles of Incorporation, as amended, to increase the number of authorized shares of Common Stock from 18,750,000 to 750,000,000. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes, if any, will have the same effect as votes against the matter.

Proposal 2 –Amendment to the Company’s 2018 Equity Incentive Plan to Increase the Number of Shares Issuable Under the 2018 Equity Incentive Plan and to Extend the Plan Term. The affirmative “FOR” vote of a majority of the votes cast live via the internet or represented by proxy at the annual meeting and entitled to vote on the proposal is required to approve an amendment to the Company’s 2018 Equity Incentive Plan (the “Plan”) to increase the number of shares of Common Stock reserved for issuance thereunder by 2,000,000 shares and to extend the term of the Plan. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions are not deemed to be votes cast and will have no impact on the outcome of the vote. Broker non-votes are not deemed to be votes cast, are not included in the tabulation of voting results on this proposal, and will not affect the outcome of voting on this proposal.

| 7 |

| Table of Contents |

Proposal 3 – Approval of Adjournment. The affirmative “FOR” vote of holders of a majority of the votes cast live via the internet or represented by proxy at the annual meeting and entitled to vote on the proposal, is required for any adjournment of the special meeting to solicit additional proxies in the event there are insufficient votes to approve Proposal 1 and/or Proposal 2. Abstentions are not deemed to be votes cast and will have no impact on the outcome of the vote. Broker non-votes are not deemed to be votes cast, are not included in the tabulation of voting results on this proposal, and will not affect the outcome of voting on this proposal.

Voting Shares Registered in Your Name

If you are a stockholder of record, that is, you have a stock certificate or an account with our transfer agent, American Stock Transfer & Trust Company, LLC, you may vote in one of four ways:

|

| · | Vote via the internet. You may submit a proxy over the Internet at www.proxyvote.com 24 hours a day, seven days a week. You will be asked to provide the company number and 16-digit control number from your proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time, on December 2, 2020; |

|

|

|

|

|

| · | Vote by telephone. You may submit a proxy using a touch-tone telephone by calling 1‑800‑690‑6903, 24 hours a day, seven days a week. You will be asked to provide the company number and 16-digit control number from your proxy card. Telephone voting is available 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time, on December 2, 2020; |

|

|

|

|

|

| · | Vote by Mail. If you received printed proxy materials, you may direct how your shares are voted at the Special Meeting by completing, signing, and dating each proxy card received and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Your completed, signed and dated proxy card must be received prior to the Special Meeting; or |

|

|

|

|

|

| · | Vote during the Special Meeting live via the internet. If you plan to attend the Special Meeting live via webcast, you may vote by following the instructions posted at www.virtualshareholdermeeting.com/ARTL2020SM. |

Votes submitted via the internet or by telephone must be received by 11:59 p.m., Eastern Time, on Wednesday, December 2, 2020. Submitting your proxy via the internet, by telephone or by mail will not affect your right to vote during the Special Meeting live via the internet. For additional information, please see “Revocability of Proxies” below.

Voting Shares Registered in the Name of a Broker, Bank or Other Agent

Most beneficial owners holding stock in “street name” will receive instructions for voting their shares from their broker, bank or other agent. Please see the materials provided by your broker, bank or other agent for voting instructions.

| 8 |

| Table of Contents |

Revocability of Proxies

If you are a stockholder of record, once you have submitted your proxy by mail, telephone or internet, you may revoke it at any time before it is voted at the Special Meeting. You may revoke your proxy in any one of the following three ways:

|

| · | You may submit another proxy marked with a later date (which automatically revokes your earlier proxy) by mail or telephone or via the internet by the applicable deadline as described above; |

|

|

|

|

|

| · | You may provide written notice that you wish to revoke your proxy to our Secretary at Artelo Biosciences, Inc., Attn: Secretary, 888 Prospect Street, Suite 210, La Jolla, California 92037 by no later than the close of business on Wednesday, December 2, 2020; or |

|

|

|

|

|

| · | You may attend the Special Meeting and submit your vote live via the internet. Attendance at the Special Meeting live via the internet will not, by itself, cause your previously granted proxy to be revoked. |

If you are a beneficial owner holding shares in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other agent in accordance with the instructions they provided (see “Voting Shares Registered in the Name of a Broker, Bank or Other Agent” above).

Tabulation of Votes

A representative from Broadridge will act as inspector of elections and tabulate the votes at the Special Meeting. All shares represented by valid proxies received before the Special Meeting will be voted. If you submit a valid proxy containing instructions regarding how to vote with respect to any matter to be acted upon, your shares will be voted in accordance with those instructions. If you submit a valid proxy with no instructions, then your shares will be voted by the individual we have designated as proxy for the Special Meeting in the following manner:

|

| · | “FOR” the amendment of the Company’s Articles of Incorporation to increase the number of authorized shares of Common Stock from 18,750,000 to 750,000,000; |

|

|

|

|

|

| · | “FOR” the amendment to the Company’s 2018 Plan to increase the number of shares of Common Stock reserved for issuance thereunder by 2,000,000 shares and to extend the term of the Plan; and |

|

|

|

|

|

| · | “FOR” the authorization of one or more adjournments of the Special Meeting to solicit additional proxies in the event there are insufficient votes to approve Proposal 1 or Proposal 2 above. |

In addition, the individual that we have designated as proxy for the Special Meeting will have discretionary authority to vote your shares with respect to any other business that may properly come before the Special Meeting or any adjournment or postponement thereof.

Voting Results

Preliminary voting results are expected to be announced at the Special Meeting. Voting results will be tallied by the inspector of elections and reported in a Current Report on Form 8-K (the “Form 8-K”) that we will file with the SEC within four business days of the Special Meeting. If the voting results reported in the Form 8-K are preliminary, we will subsequently file an amendment to the Form 8-K to report the final voting results within four business days of the date on which the final voting results are known.

| 9 |

| Table of Contents |

Proxy Solicitation

This proxy solicitation is made by the Board and we will bear the entire cost of soliciting proxies for the Special Meeting, including costs associated with the preparation, assembly, printing and mailing of the proxy materials and any additional information furnished to stockholders. We will provide copies of the proxy materials to brokers, banks and other agents holding shares of our Common Stock in their name for the benefit of others for forwarding to the beneficial owners. We may reimburse such brokers, banks or other agents for their costs associated with forwarding the proxy materials to the beneficial owners. We have retained The Proxy Advisory Group, LLC to assist with the solicitation of proxies and provide related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed $30,000 in total. Proxy solicitations will be made primarily through the mail, but may be supplemented by telephone, email, or other electronic means by The Proxy Advisory Group, or by our directors, executive officers, employees or other agents without additional compensation to such individuals.

Householding of Proxy Materials

The SEC has adopted rules that permit brokers, banks and other agents to satisfy the delivery requirements for proxy statements and annual reports, or notice of their availability, by delivering a single proxy statement and annual report to two or more stockholders sharing the same address. This process, which is commonly referred to as “householding,” can provide added convenience for our stockholders and additional cost savings for us.

We expect that a number of brokers, banks and other agents with account holders who are our stockholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker, bank or other agent that they will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent to the householding of communications. If at any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report please either (i) notify your broker, bank or other agent, (ii) direct your written request to Artelo Biosciences, Inc., Attn: Investor Relations, 888 Prospect Street, Suite 210, La Jolla, California 92037, or (iii) contact us by phone at (760) 943-1689. Upon receipt of any such written or oral request, we undertake to promptly deliver free of charge a separate copy of the proxy statement, annual report to a stockholder at a shared address to which a single copy of these documents was delivered. Stockholders who currently receive multiple copies of the proxy statement and annual report, or notices of availability, at their address and would like to request householding of their communications should notify their broker, bank or other agent.

| 10 |

| Table of Contents |

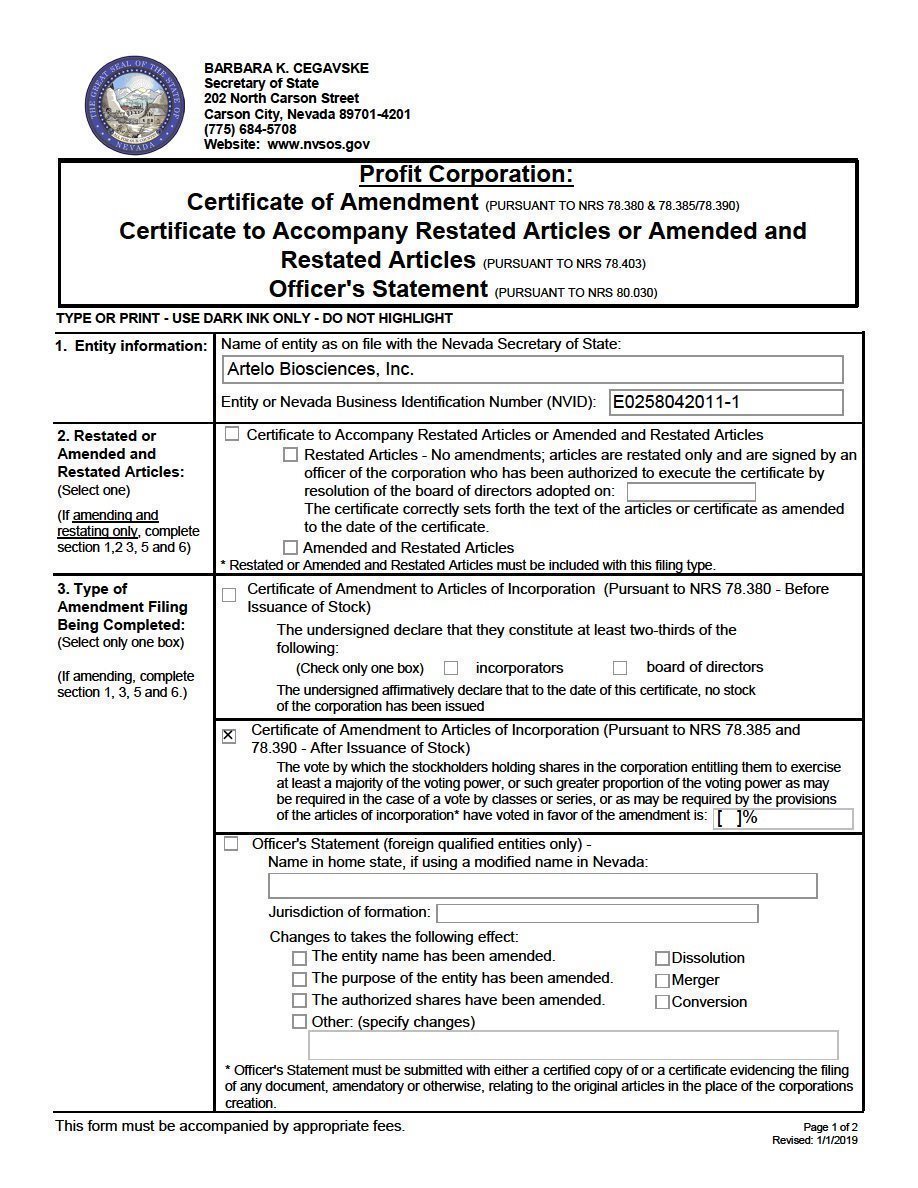

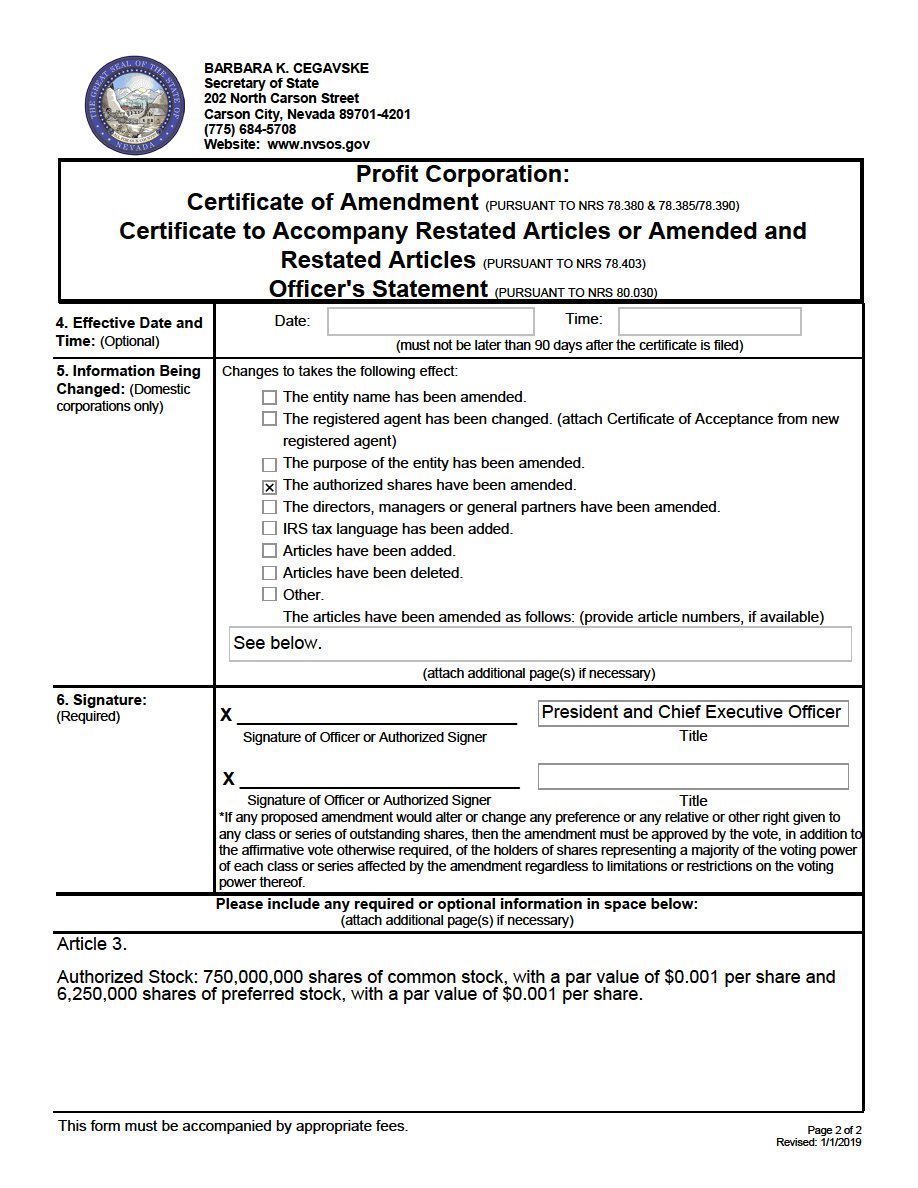

AMENDMENT OF ARTICLES OF INCORPORATION

The Company’s Articles of Incorporation, as amended, currently authorize the issuance of 18,750,000 shares of Common Stock and 6,250,000 shares of the Company’s preferred stock (the “Preferred Stock”). On October 14, 2020, the Company had 15,111,587 shares of Common Stock issued and outstanding. In addition, there were 281,834 shares issuable upon the exercise of options or vesting of restricted stock awards granted under the Company’s 2018 Equity Incentive Plan (the “2018 Plan”), 2,334,937 shares of Common Stock issuable upon exercise of warrants and 1,266,904 shares of Common Stock reserved for future issuance under the 2018 Plan. The Company has not issued any shares of Preferred Stock.

The Board has unanimously approved, subject to stockholder approval, an amendment to the Company’s Articles of Incorporation, as amended, to effect an increase the number of authorized shares of Common Stock from 18,750,000 to 750,000,000 (the “Authorized Share Increase”). The Board has not approved an increase in the shares of Preferred Stock. The additional shares of Common Stock authorized by the Authorized Share Increase, if and when issued, would have the same rights and privileges as the shares of Common Stock previously authorized. A copy of the certificate of amendment for the Authorized Share Increase (the “Certificate of Amendment”) to the Articles of Incorporation, as amended, is attached hereto as Appendix A.

The Board has recommended that the proposed Certificate of Amendment for the Authorized Share Increase be presented to the Company’s stockholders for approval.

Reasons for the Increase in Authorized Shares

On the record date, 15,111,587 shares of our Common Stock were outstanding, out of the 18,750,000 authorized in our Articles of Incorporation. The additional shares of Common Stock authorized by the Authorized Share Increase could be issued at the discretion of the Board from time to time for any proper corporate purpose, including, without limitation, the acquisition of other businesses, the raising of additional capital for use in our business, including in connection with the issuance and exercise of warrants, a split of or dividend on then outstanding shares or in connection with any employee stock plan or program. Except to the extent required by applicable law or regulation, any future issuances of authorized shares of Common Stock may be approved by the Board without further action by the stockholders. The availability of additional shares of Common Stock would be particularly important in the event that the Board needs to undertake any of the foregoing actions on an expedited basis in order to avoid the time and expense of seeking stockholder approval in connection with the contemplated issuance of Common Stock, where such approval might not otherwise be required.

| 11 |

| Table of Contents |

Although the Board will issue Common Stock only when required or when the Board considers such issuance to be in the Company’s best interests, the issuance of additional Common Stock may, among other things, have a dilutive effect on the earnings per share (if any) and on the equity and voting rights of our existing stockholders.

Additionally, the presence of such additional authorized but unissued shares of Common Stock could discourage unsolicited business combination transactions which might otherwise be desirable to stockholders. While it may be deemed to have potential anti-takeover effects, the proposed Authorized Share Increase is not prompted by any specific effort or takeover threat currently perceived by management. In addition, we do not have any plans to implement additional measures having anti-takeover effects. The Board believes that the benefits of providing it with the flexibility to issue shares without delay for any proper business purpose, including as an alternative to an unsolicited business combination opposed by the Board, outweigh the possible disadvantages of dilution and discouraging unsolicited business combination proposals and that it is prudent and in the best interests of stockholders to provide the advantage of greater flexibility which will result from the Authorized Share Increase.

Anti-Takeover and Dilutive Effects

The shares of Common Stock that are authorized but unissued provide the Board with flexibility to effect, among other transactions, public or private financings, including the issuance and exercise of warrants, acquisitions, stock dividends, stock splits and the granting of equity incentive awards. However, these authorized but unissued shares may also be used by the Board, consistent with and subject to its fiduciary duties, to deter future attempts to gain control of us or make such actions more expensive and less desirable. The Authorized Share Increase would continue to give our Board authority to issue additional shares from time to time without delay or further action by the stockholders except as may be required by applicable law or regulations. The Authorized Share Increase is not being recommended in response to any specific effort of which we are aware to obtain control of us, nor does our Board have any present intent to use the authorized but unissued Common Stock to impede a takeover attempt.

| 12 |

| Table of Contents |

Except for the Company’s obligation to issue Common Stock upon the exercise of outstanding options and warrants, we have no specific plan, commitment, arrangement, understanding or agreement, either oral or written, regarding the issuance of Common Stock subsequent to the Authorized Share Increase at this time, and we have not allocated any specific portion of the authorized number of shares to any particular purpose.

The Authorized Share Increase would increase our number of authorized but unissued shares of stock, which could negatively impact a potential investor if they purchased our Common Stock.

The Authorized Share Increase will increase the number of authorized shares of Common Stock and, as a result, the Board’s ability to issue authorized and unissued shares without further stockholder action. The issuance of additional shares of Common Stock may have a dilutive effect on earnings per share and relative voting power and may cause a decline in the trading price of our Common Stock. We could use the shares that are available for future issuance in dilutive equity financing transactions, for issuances upon exercise of currently outstanding warrants, or to oppose a hostile takeover attempt or delay or prevent changes in control or changes in or removal of management, including transactions that are favored by a majority of the stockholders or in which the stockholders might otherwise receive a premium for their shares over then-current market prices or benefit in some other manner. We may seek additional financing in the future. Other than the foregoing potential uses for our shares of Common Stock, we have no existing plans to issue any of the authorized, but unissued and unreserved shares, whether available as a result of the proposed Authorized Share Increase or otherwise.

Procedure for Effecting the Authorized Share Increase

When the Board decides to implement the Authorized Share Increase, the Company will promptly file the Certificate of Amendment with the Secretary of State of the State of Nevada to amend its existing Articles of Incorporation, as amended. The Authorized Share Increase will become effective on the date of filing the Certificate of Amendment. The text of the Certificate of Amendment is set forth in Appendix A to this proxy statement. The text of the Certificate of Amendment is subject to modification to include such changes as may be required by the office of the Secretary of State of the State of Nevada and as the Board deems necessary and advisable to effect the Authorized Share Increase.

Required Vote

Approval of this Proposal requires the affirmative “FOR” vote of holders of a majority of outstanding shares entitled to vote via the internet or represented by proxy at the annual meeting and entitled to vote on the proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes will have the same effect as a vote against the proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE AMENDMENT OF THE ARTICLES OF INCORPORATION.

| 13 |

| Table of Contents |

APPROVAL OF AMENDMENT TO THE 2018 EQUITY INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES ISSUABLE UNDER THE 2018 EQUITY INCENTIVE PLAN AND TO EXTEND THE PLAN TERM

Assuming Proposal 1 is approved by the Company’s stockholders, the Company’s stockholders are also being asked to approve an amendment to the 2018 Equity Incentive Plan (the “2018 Plan”), which would increase the number of shares of common stock reserved for issuance under the 2018 Plan by 2,000,000 shares. Under the current terms of the 2018 Plan, this amendment will also result in an extension of the term of the 2018 Plan until October 2030.

The 2018 Plan is the only equity plan of the Company available for grant of equity awards to employees, directors and consultants of the Company. As previously approved by the stockholders, the total number of shares of our common stock reserved for issuance under the 2018 Plan represented approximately 31% of our outstanding common stock. If our stockholders approve this amendment (the “Share Reserve Increase”), then (i) the total number of shares of our common stock that will be reserved for issuance would represent approximately 25% of our outstanding common stock as of October 14, 2020 and (ii) the 2018 Plan will continue in effect until October 2030.

Our Board believes that our success depends on the ability to attract and retain the best available personnel. Equity awards are used as compensation vehicles by most, if not all, of the companies with which we compete for talent, and our Board believes that providing equity awards is critical to attract and retain key contributors. Additionally, our Board believes that equity awards align the interests of service providers and stockholders by giving service providers an ownership stake in the company, motivate service providers to achieve outstanding performance, and provide an effective means of rewarding service providers for their contributions to our success.

In determining to seek stockholder approval of the proposed Share Reserve Increase, the Board determined that in order to retain our current personnel and properly align their interests with those of our stockholders, we would need to grant additional equity awards to them. Additionally, we expect to grow the number of our employees in the future, and to attract new employees we believe it will be necessary to grant equity awards to them as well. The 2018 Plan is our sole plan for providing future equity incentives to our service providers. Our Board determined that the shares of our common stock currently reserved for issuance under our 2018 Plan may be insufficient to meet our immediate need to retain our current personnel and align their interests sufficiently with our stockholders, and to recruit new employees.

In determining the size of the share reserve increase to request, our Board considered the size of grants that would be appropriate to retain our current personnel and align their interests with those of our stockholders, as well as to recruit and attract new employees and similarly align their interests with those of our stockholders.

After consideration of these factors, the Board determined that increasing the share reserve by 2,000,000 shares would be appropriate to be able to properly incentivize future and current employees, at least for the immediate term. We expect that, if stockholders approve the Share Reserve Increase and considering the automatic share increase feature of our 2018 Plan, our share reserve will be sufficient for the foreseeable future. If stockholders do not approve the proposed 2,000,000 share increase, in order to remain competitive in hiring and retaining high quality employees, it may become necessary to replace prior equity awards with cash components of compensation. We do not believe increasing cash compensation to make up for any shortfall in equity compensation would be practical or advisable because we believe that a combination of equity awards and cash compensation provide a more effective compensation strategy than cash alone for attracting, retaining and motivating our employees long-term and aligning employees’ and stockholders’ interests. In addition, any significant increase in cash compensation in lieu of equity awards could substantially increase our operating expenses and increase the negative cash flow from our operations, which could adversely affect our business results and could adversely affect our business strategy, including the continued development of our product candidate pipeline.

| 14 |

| Table of Contents |

Summary of the 2018 Plan

The following is a summary of the principal features of the 2018 Plan and its operation. The summary is qualified in its entirety by reference to the 2018 Plan set forth in Appendix B.

The 2018 Plan provides for the grant of incentive stock options (within the meaning of Section 422 of the Code), or ISOs, to our employees and any of our parent and subsidiary corporations’ employees, and for the grant of nonstatutory stock options, or NSOs, restricted stock, and restricted stock units to our employees, directors and consultants, and our parent and subsidiary corporations’ employees and consultants. As of October 14, 2020, approximately (i) three (3) employees (including officers), (ii) five (5) non-employee directors, and (iii) seventeen (17) consultants were eligible to receive awards under the 2018 Plan.

Authorized Shares

Assuming stockholder approval of this Proposal 2, a total of 3,548,738 shares of our common stock would be reserved for issuance pursuant to our 2018 Plan, of which 281,834 are issuable upon the exercise of currently outstanding options. The number of shares available for issuance under our 2018 Plan increases on the first day of each fiscal year by the least of:

|

| · | 15% of the outstanding shares of our common stock as of the last day of the immediately preceding fiscal year; |

|

|

|

|

|

| · | 7,500,000 shares; or |

|

|

|

|

|

| · | such other amount as our board of directors may determine. |

If an award expires or becomes unexercisable without having been exercised in full, is surrendered pursuant to an exchange program, or, with respect to restricted stock or restricted stock units is forfeited to or repurchased by us due to the failure to vest, the unpurchased shares (or for awards other than stock options or stock appreciation rights, the forfeited or repurchased shares) will become available for future grant or sale under the 2018 Plan (unless the 2018 Plan has terminated). With respect to stock appreciation rights, only the net shares actually issued will cease to be available under the 2018 Plan and all remaining shares under stock appreciation rights will remain available for future grant or sale under the 2018 Plan (unless the 2018 Plan has terminated). Shares that have actually been issued under the 2018 Plan will not be returned to the 2018 Plan except if shares issued pursuant to awards of restricted stock or restricted stock units are repurchased by or forfeited to us due to the failure to vest, such shares will become available for future grant under the 2018 Plan. Shares used to pay the exercise price of an award or satisfy the tax withholding obligations related to an award will become available for future grant or sale under the 2018 Plan. To the extent an award is paid out in cash rather than shares, such cash payment will not result in a reduction in the number of shares available for issuance under the 2018 Plan.

Plan Administration

Our board of directors or one or more committees appointed by our board of directors administers our 2018 Plan. Subject to the provisions of our 2018 Plan, the administrator has the power to administer our 2018 Plan and make all determinations deemed necessary or advisable for administering the 2018 Plan, such as the power to determine the fair market value of our common stock, select the service providers to whom awards may be granted, determine the number of shares covered by each award, approve forms of award agreements for use under the 2018 Plan, determine the terms and conditions of awards (such as the exercise price, the time or times at which awards may be exercised, any vesting acceleration or waiver or forfeiture restrictions and any restriction or limitation regarding any award or the shares relating to the award), construe and interpret the terms of our 2018 Plan and awards granted under it, prescribe, amend and rescind rules relating to our 2018 Plan (including creating sub-plans), temporarily suspend the exercisability of an award if the administrator deems such suspension to be necessary or appropriate for administrative purposes, and allow a participant to defer the receipt of payment of cash or the delivery of shares that would otherwise be due to such participant under an award. The administrator also has the power to modify or amend each award (such as the discretionary authority to extend the post-termination exercisability period of awards), except that no option or stock appreciation right may be extended beyond its original maximum term. The administrator has the authority to institute an exchange program by which outstanding awards may be surrendered or cancelled in exchange for awards of the same type (which may have a higher or lower exercise price and/or different terms), awards of a different type, and/or cash, by which participants would have the opportunity to transfer outstanding awards to a financial institution or other person or entity selected by the administrator, or by which the exercise price of an outstanding award is increased or reduced. The administrator’s decisions, interpretations, and other actions are final and binding on all participants and any other holders of awards and will be given the maximum deference permitted by applicable laws.

| 15 |

| Table of Contents |

Stock Options

We may grant stock options under the 2018 Plan. The per share exercise price of options granted under our 2018 Plan must be at least equal to the fair market value of a share of our common stock on the date of grant. The term of an option granted under our 2018 Plan may not exceed 10 years. With respect to any incentive stock option granted to an employee who owns more than 10% of the voting power of all classes of our (or any parent or subsidiary of ours) outstanding stock, the term of the incentive stock option must not exceed five years and the per share exercise price of the incentive stock option must equal at least 110% of the fair market value of a share our common stock on the grant date. The administrator will determine the methods of payment of the exercise price of an option, which may include cash, shares or other property acceptable to the administrator to the extent permitted by applicable law. After termination of a participant’s service, he or she may exercise the vested portion of his or her option for six months following a termination due to death or disability, for 30 days following a termination for any other reason, or for any longer period specified in the applicable option agreement. However, in no event may an option be exercised later than the expiration of its term. Subject to the provisions of our 2018 Plan, the administrator determines the other terms of options.

Stock Appreciation Rights

We may grant stock appreciation rights under our 2018 Plan. Stock appreciation rights allow the recipient to receive the appreciation in the fair market value of the underlying shares of our common stock between the date of grant and the exercise date. Stock appreciation rights may not have a term exceeding 10 years. Subject to the provisions of our 2018 Plan, the administrator determines the terms of stock appreciation rights, including when such rights become exercisable and whether to pay any appreciation in cash or with shares of our common stock, or a combination thereof, except that the per share exercise price for the shares of our common stock to be issued pursuant to the exercise of a stock appreciation right will be no less than 100% of the fair market value of a share of our common stock on the date of grant. After termination of a participant’s service, he or she may exercise the vested portion of his or her stock appreciation right for six months following a termination due to death or disability, for 30 days following a termination for any other reason, or for any longer period specified in the applicable award agreement. However, in no event may stock appreciation rights be exercised later than the expiration of their term.

Restricted Stock

We may grant restricted stock under our 2018 Plan. Restricted stock awards are grants of shares of our common stock that vest in accordance with terms and conditions established by the administrator. The administrator will determine the number of shares of restricted stock granted to any employee, director or consultant and, subject to the provisions of our 2018 Plan, will determine the terms and conditions of such awards. The administrator may impose whatever vesting conditions it determines to be appropriate (for example, the administrator may set restrictions based on the achievement of specific performance goals or continued service to us), except the administrator, in its sole discretion, may accelerate the time at which any restrictions will lapse or be removed. Recipients of restricted stock awards generally will have voting and dividend rights with respect to such shares upon grant without regard to vesting, unless the administrator provides otherwise. Shares of restricted stock that do not vest are subject to our right of repurchase or forfeiture.

| 16 |

| Table of Contents |

Restricted Stock Units

We may grant restricted stock units under our 2018 Plan. Restricted stock units are bookkeeping entries representing an amount equal to the fair market value of one share of our common stock. Subject to the provisions of our 2018 Plan, the administrator will determine the terms and conditions of restricted stock units, including the vesting criteria and the form and timing of payment. The administrator may set vesting criteria based upon the achievement of company-wide, business unit, or individual goals (such as continued employment or service) or any other basis determined by the administrator in its discretion. The administrator, in its sole discretion, may pay earned restricted stock units in the form of cash, in shares or in some combination thereof. In addition, the administrator, in its sole discretion, may accelerate the time at which any restricted stock units will vest.

Non-Transferability of Awards

Unless the administrator provides otherwise, our 2018 Plan generally does not allow for the transfer of awards and only the recipient of an award may exercise an award during his or her lifetime.

Certain Adjustments

In the event of certain changes in our capitalization, to prevent diminution or enlargement of the benefits or potential benefits available under our 2018 Plan, the administrator will adjust the number and class of shares that may be delivered under our 2018 Plan and/or the number, class and price of shares covered by each outstanding award.

Dissolution or Liquidation

In the event of our proposed liquidation or dissolution, the administrator will notify participants as soon as practicable before the effective date of such proposed transaction, and to the extent not exercised, all awards will terminate immediately before the consummation of such proposed transaction.

Merger or Change in Control

Our 2018 Plan provides that in the event of our merger with or into another corporation or a change in control, as defined under the 2018 Plan, each outstanding award will be treated as the administrator determines, without a participant’s consent. The administrator is not required to treat all awards, all awards held by a participant, or all awards of the same type similarly.

If a successor corporation does not assume or substitute for any outstanding award, then the participant will fully vest in and have the right to exercise all of his or her outstanding options and stock appreciation rights, all restrictions on restricted stock and restricted stock units will lapse, and for awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels and all other terms and conditions met, in all cases, unless specifically provided otherwise under the applicable award agreement or other written agreement between the participant and us or any of our subsidiaries or parents. If an option or stock appreciation right is not assumed or substituted in the event of a merger or change in control, the administrator will notify the participant in writing or electronically that such option or stock appreciation right will be exercisable for a period of time determined by the administrator in its sole discretion and the option or stock appreciation right will terminate upon the expiration of such period.

Forfeiture Events

Awards will be subject to any clawback policy of ours, and the administrator also may specify in an award agreement that the participant’s rights, payments, and benefits with respect to an award will be subject to reduction, cancellation, forfeiture, or recoupment upon the occurrence of certain specified events. The administrator may require a participant to forfeit, return, or reimburse us all or a portion of the award and any amounts paid under the award in order to comply with such clawback policy or applicable laws, if any.

| 17 |

| Table of Contents |

Amendment; Termination

The Board has the authority to amend, alter, suspend, or terminate our 2018 Plan, provided such action does not impair the rights of any participant. Our 2018 Plan automatically will terminate in 2030, unless we terminate it sooner.

Summary of U.S. Federal Income Tax Consequences

The following summary is intended only as a general guide to the material U.S. federal income tax consequences of participation in the 2018 Plan. The summary is based on existing U.S. laws and regulations, and there can be no assurance that those laws and regulations will not change in the future. The summary does not purport to be complete and does not discuss the tax consequences upon a participant’s death, or the provisions of the income tax laws of any municipality, state or non-U.S. jurisdiction to which the participant may be subject. As a result, tax consequences for any particular participant may vary based on individual circumstances.

Incentive Stock Options

No taxable income is reportable when an ISO is granted or exercised, although the exercise may subject the participant to the alternative minimum tax or may affect the determination of the participant’s alternative minimum tax (unless the shares are sold or otherwise disposed of in the same year). If the participant exercises the option and then later sells or otherwise disposes of the shares acquired more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares before the end of the two or one year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option. For purposes of the alternative minimum tax, the difference between the option exercise price and the fair market value of the shares on the exercise date is treated as an adjustment item in computing the participant’s alternative minimum taxable income in the year of exercise. In addition, special alternative minimum tax rules may apply to certain subsequent disqualifying dispositions of the shares or provide certain basis adjustments or tax credits for alternative minimum tax purposes.

Nonstatutory Stock Options

No taxable income is reportable when a nonstatutory stock option with a per share exercise price at least equal to the fair market value of a share of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the exercised shares subject to the option. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by us. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss to the participant.

Stock Appreciation Rights

No taxable income is reportable when a stock appreciation right with a per share exercise price equal to at least the fair market value of a share of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received and the fair market value of any shares received. Any taxable income recognized in connection with the exercise of a stock appreciation right by an employee of the Company is subject to tax withholding by us. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss to the participant.

Restricted Stock

A participant acquiring shares of restricted stock generally will recognize ordinary income equal to the fair market value of the shares on the vesting date. If the participant is an employee, such ordinary income generally is subject to withholding of income and employment taxes. The participant may elect pursuant to Section 83(b) of the Code to accelerate the ordinary income tax event to the date of acquisition by filing an election with the Internal Revenue Service no later than 30 days after the date the shares are acquired. Upon the sale of shares acquired pursuant to a restricted stock award, any gain or loss, based on the difference between the sale price and the fair market value on the date the ordinary income tax event occurs, will be taxed as capital gain or loss.

| 18 |

| Table of Contents |

Restricted Stock Units

There are no immediate tax consequences of receiving an award of restricted stock units. A participant who is awarded restricted stock units generally will be required to recognize ordinary income in an amount equal to the fair market value of the shares issued to and/or the cash received by such participant at the end of the applicable vesting period or, if later, the settlement date elected by the administrator or a participant. If the participant is an employee, such ordinary income generally is subject to withholding of income and employment taxes. Any additional gain or loss recognized upon any later disposition of any shares received would be capital gain or loss.

Medicare Surtax

A participant’s annual “net investment income,” as defined in Section 1411 of the Code may be subject to a 3.8% federal surtax (generally referred to as the “Medicare Surtax”). Net investment income may include capital gain and/or loss arising from the disposition of shares subject to a participant’s awards under the 2018 Plan. Whether a participant’s net investment income will be subject to the Medicare Surtax will depend on the participant’s level of annual income and other factors

Section 409A

Section 409A of the Code (“Code Section 409A”) provides certain requirements for nonqualified deferred compensation arrangements with respect to an individual’s deferral and distribution elections and permissible distribution events. Awards granted under the 2018 Plan with a deferral feature will be subject to the requirements of Code Section 409A. Code Section 409A also generally provides that distributions must be made on or following the occurrence of certain events (e.g., the individual’s separation from service, a predetermined date, or the individual’s death). For certain individuals who are officers, subject to certain exceptions, Code Section 409A requires that distributions in connection with the officer’s separation from service commence no earlier than 6 months after such officer’s separation from service.

If an award granted under the 2018 Plan is subject to and fails to satisfy the requirements of Code Section 409A, the recipient of that award may recognize ordinary income on the amounts deferred under the award, to the extent vested, which may be prior to when the compensation is actually or constructively received. Also, if an award that is subject to Code Section 409A fails to comply with Code Section 409A’s provisions, Code Section 409A imposes an additional 20% federal income tax on compensation recognized as ordinary income, as well as interest on such deferred compensation. Certain states, such as California, have enacted laws similar to Code Section 409A which impose additional taxes, interest and penalties on nonqualified deferred compensation arrangements. The Company will also have withholding and reporting requirements with respect to such amounts. In no event will the Company or any of its parents or subsidiaries have any responsibility, obligation, or liability under the terms of the 2018 Plan to reimburse, indemnify, or hold harmless a participant or any other person in respect of awards for any taxes, interest or penalties imposed, or other costs incurred, as a result of Code Section 409A.

Tax Effect for the Company

We generally will be entitled to a tax deduction in connection with an award under the 2018 Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules limit the deductibility of compensation paid to our Chief Executive Officer and other “covered employees” within the meaning of Code Section 162(m). Under Code Section 162(m), the annual compensation paid to any of these specified employees will be deductible only to the extent that it does not exceed $1,000,000.

| 19 |

| Table of Contents |

Plan Benefits

All awards to employees, directors, and consultants under the 2018 Plan are made at the discretion of the administrator. Therefore, the benefits and amounts that will be received or allocated under the 2018 Plan are not determinable at this time. Our executive officers and non-employee directors have an interest in this proposal because they are eligible to receive awards under the 2018 Plan. The following table sets forth (i) the aggregate number of shares covered by options granted under the 2018 Plan during the fiscal year ended August 31, 2020, to (A) each of our named executive officers, (B) our executive officers, as a group, (C) our directors who are not executive officers, as a group, and (D) all employees and contractors who are not executive officers, as a group and (ii) the average per share exercise price of such options. As of October 14, 2020, the closing sales price of a share of common stock as reported on the Nasdaq Stock Market was $0.7780 per share.

| Name of Individual or Group |

| Number of Shares Subject to Options Granted |

|

| Average Per Share Exercise Price of Options Granted |

| ||

| Gregory D. Gorgas Chief Executive Officer, President, Chief Financial Officer, Treasurer and Secretary |

|

| 75,000 |

|

| $ | 1.99 |

|

| All executive officers, as a group |

|

| 75,000 |

|

| $ | 1.99 |

|

| All directors who are not executive officers, as a group |

|

| 146,750 |

|

| $ | 2.97 |

|

| All employees and contractors who are not executive officers, as a group |

|

| 60,084 |

|

| $ | 7.24 |

|

Required Vote

Approval of this Proposal requires the affirmative “FOR” vote of a majority of the votes cast live via the internet or represented by proxy at the annual meeting and entitled to vote on the proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes will not affect the outcome of voting on this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT OF THE COMPANY’S 2018 EQUITY INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES ISSUABLE UNDER THE 2018 EQUITY INCENTIVE PLAN AND EXTEND THE PLAN TERM.

| 20 |

| Table of Contents |

ADJOURNMENT OF SPECIAL MEETING

The Board has approved the submission to the stockholders of a proposal to approve one or more adjournments of the special meeting in the event that there is not a sufficient number of votes at the special meeting to approve Proposal 1 and/or Proposal 2. In order to permit proxies that have been timely received to be voted for such adjournments, we are submitting this proposal as a separate matter for your consideration. If it is necessary to adjourn the special meeting, the adjournment is for a period of less than 30 days and the record date remains unchanged, no notice of the time and place of the reconvened meeting will be given to stockholders, other than an announcement made at the special meeting.

Required Vote

Approval of this Proposal requires the affirmative “FOR” vote of a majority of the votes cast live via the internet or represented by proxy at the annual meeting and entitled to vote on the proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes will not affect the outcome of voting on this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” APPROVAL OF THE ADJOURNMENT OF SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES IN THE EVENT THERE ARE INSUFFICIENT VOTES TO APPROVE PROPOSAL 1 AND/OR PROPOSAL 2.

| 21 |

| Table of Contents |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of October 27, 2020, certain information with respect to the beneficial ownership of our common and preferred shares by each shareholder known by us to be the beneficial owner of more than 5% of our common and preferred shares, as well as by each of our current directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of common and preferred stock, except as otherwise indicated. Beneficial ownership consists of a direct interest in the shares of common and preferred stock, except as otherwise indicated.

Except as otherwise noted below, the address of each of the individuals and entities named in the table below is c/o Artelo Biosciences, Inc., 888 Prospect Street, Suite 210, La Jolla, California 92037. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

| Name and Address of Beneficial Owner |

| Shares Beneficially Owned |

| Percentage of Shares Beneficially Owned |

| |

|

|

|

|

|

|

| |

| Directors and Named Executive Officers |

|

|

|

|

| |

|

|

|

|

|

|

| |

| Gregory D. Gorgas(1) |

| 305,731 Common / Direct |

|

| 2.02 | % |

|

|

|

|

|

|

|

|

| Connie Matsui(2) |

| 83,167 Common / Direct |

| * |

| |

|

|

|

|

|

|

|

|

| Steven Kelly(3) |

| 34,750 Common / Direct |

| * |

| |

|

|

|

|

|

|

|

|

| Douglas Blayney(4) |

| 30,500 Common / Direct |

| * |

| |

|

|

|

|

|

|

|

|

| R. Martin Emanuele(5) |

| 38,390 Common/Direct |

| * |

| |

|

|

|

|

|

|

|

|

| John W. Beck (6) |

| 15,000 Common / Direct |

| * |

| |

| All Current Directors and Executive Officers as a Group |

| 507,538 Common |

|

| 3.36 | % |

|

|

|

|

|

|

|

|

| 5% Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kingsbrook Opportunities Master Fund LP c/o Kingsbrook Partners LP, 689 Fifth Avenue, 12th Floor, New York, NY 10022. |

| 800,000 Common / Direct |

|

| 5.29 | % |

|

|

|

|

|

|

|

|

| Iroquois Capital Management L.L.C. 125 Park Avenue, 25th Floor, New York, NY 10017 |

| 920,000 Common / Direct |

|

| 6.09 | % |

|

|

|

|

|

|

|

|

| Empery Asset Management, LP 1 Rockefeller Plaza, Suite 1205 New York, New York 10020 |

| 920,000 Common / Direct |

|

| 6.09 | % |

|

|

|

|

|

|

|

|

| CVI Investments, Inc. P.O. Box 309GT, Ugland Houe, South Church Street, George Town, Grand Cayman, YY1-1104 Cayman Islands |

| 920,000 Common / Direct |

|

| 6.09 | % |

|

|

|

|

|

|

|

|

| Alpha Capital Anstalt Lettstrasse 32, FL-9490 Vaduz, Furstentums, Liechtenstein |

| 800,000 Common / Direct |

|

| 5.29 | % |

____________

| * | Less than 1% |

| (1) | Consists of 262,176 shares held by Gregory Gorgas, option to purchase 23,445 shares of common stock and warrants to purchase 20,110 shares of common stock that are exercisable within 60 days of October 27, 2020. |

| (2) | Consists of 56,667 shares held by Connie Matsui and option to purchase 26,500 shares of common stock that are exercisable within 60 days of October 27, 2020. |

| (3) | Consists of 12,500 shares held by Steven Kelly and option to purchase 22,250 shares of common stock that are exercisable within 60 days of October 27, 2020. |

| (4) | Consists of 12,500 shares held by Douglas Blayney and option to purchase 18,000 shares of common stock that are exercisable within 60 days of October 27, 2020. |

| (5) | Consists of 12,500 shares held by R. Marty Emanuele and option to purchase 25,890 shares of common stock that are exercisable within 60 days of October 27, 2020. |

| (6) | Consists of option to purchase 15,000 shares of common stock that are exercisable within 60 days of October 27, 2020. |

Changes in Control

We are unaware of any contract or other arrangement or provisions of our Articles or Bylaws the operation of which may at a subsequent date result in a change of control of our company.

| 22 |

| Table of Contents |

We know of no other matters to be submitted at the Special Meeting. If any other matters are properly brought before the Special Meeting, it is the intention of the individuals we have designated as proxies to vote the shares that they represent on such matters in accordance with their judgment.

For further information about Artelo Biosciences, Inc., please refer to our Annual Report on Form 10-K for the year ended August 31, 2020, filed with the SEC on November 4, 2020, which is publicly available on the SEC’s website at www.sec.gov or on our website at www.artelobio.com under “Investor – SEC Filings.” You may also obtain a copy by sending a written request to Artelo Biosciences, Inc., Attn: Investor Relations, 888 Prospect Street, Suite 210, La Jolla, CA 92037.

| By Order of the Board of Directors, | |||

|

|

|

|

|

| /s/ Gregory D. Gorgas | |||

|

|

| Gregory D. Gorgas | |

| President and Chief Executive Officer | |||

| Dated: November 9, 2020 |

| 23 |

| Table of Contents |

APPENDIX A

AMENDMENT TO ARTICLES OF INCORPORATION

| Table of Contents |

| Table of Contents |

APPENDIX B

2018 EQUITY INCENTIVE PLAN

ARTELO BIOSCIENCES, INC.

2018 EQUITY INCENTIVE PLAN

(as amended June 19, 2020)

1.Purposes of the Plan. The purposes of this Plan are:

|

| · | to attract and retain the best available personnel for positions of substantial responsibility, |

|

|

|

|

|

| · | to provide additional incentive to Employees, Directors and Consultants, and |

|

|

|

|

|

| · | to promote the success of the Company’s business. |

The Plan permits the grant of Incentive Stock Options, Nonstatutory Stock Options, Stock Appreciation Rights, Restricted Stock and Restricted Stock Units.

2. Definitions. As used herein, the following definitions will apply:

(a) “Administrator” means the Board or any of its Committees as will be administering the Plan, in accordance with Section 4 of the Plan.

(b) “Applicable Laws” means the legal and regulatory requirements relating to the administration of equity-based awards, including but not limited to, under U.S. state corporate laws, U.S. federal and state securities laws, the Code, any stock exchange or quotation system on which the Common Stock is listed or quoted and the applicable laws of any foreign country or jurisdiction where Awards are, or will be, granted under the Plan.

(c) “Award” means, individually or collectively, a grant under the Plan of Options, Stock Appreciation Rights, Restricted Stock, or Restricted Stock Units.

(d) “Award Agreement” means the written or electronic agreement setting forth the terms and provisions applicable to each Award granted under the Plan. The Award Agreement is subject to the terms and conditions of the Plan.

(e) “Board” means the Board of Directors of the Company.

(f) “Change in Control” means the occurrence of any of the following events:

(i) Change in Ownership of the Company. A change in the ownership of the Company which occurs on the date that any one person, or more than one person acting as a group (“Person”), acquires ownership of the stock of the Company that, together with the stock held by such Person, constitutes more than fifty percent (50%) of the total voting power of the stock of the Company; provided, however, that for purposes of this subsection, the acquisition of additional stock by any one Person, who is considered to own more than fifty percent (50%) of the total voting power of the stock of the Company will not be considered a Change in Control; provided, further, that any change in the ownership of the stock of the Company as a result of a private financing of the Company that is approved by the Board also will not be considered a Change in Control. Further, if the stockholders of the Company immediately before such change in ownership continue to retain immediately after the change in ownership, in substantially the same proportions as their ownership of shares of the Company’s voting stock immediately prior to the change in ownership, direct or indirect beneficial ownership of fifty percent (50%) or more of the total voting power of the stock of the Company or of the ultimate parent entity of the Company, such event shall not be considered a Change in Control under this subsection (i).For this purpose, indirect beneficial ownership shall include, without limitation, an interest resulting from ownership of the voting securities of one or more corporations or other business entities which own the Company, as the case may be, either directly or through one or more subsidiary corporations or other business entities; or

| -1- |

| Table of Contents |

(ii) Change in Effective Control of the Company. If the Company has a class of securities registered pursuant to Section 12 of the Exchange Act, a change in the effective control of the Company which occurs on the date that a majority of members of the Board is replaced during any twelve (12) month period by Directors whose appointment or election is not endorsed by a majority of the members of the Board prior to the date of the appointment or election. For purposes of this subsection (ii), if any Person is considered to be in effective control of the Company, the acquisition of additional control of the Company by the same Person will not be considered a Change in Control; or

(iii) Change in Ownership of a Substantial Portion of the Company’s Assets. A change in the ownership of a substantial portion of the Company’s assets which occurs on the date that any Person acquires (or has acquired during the twelve (12) month period ending on the date of the most recent acquisition by such person or persons) assets from the Company that have a total gross fair market value equal to or more than fifty percent (50%) of the total gross fair market value of all of the assets of the Company immediately prior to such acquisition or acquisitions; provided, however, that for purposes of this subsection (iii), the following will not constitute a change in the ownership of a substantial portion of the Company’s assets: (A) a transfer to an entity that is controlled by the Company’s stockholders immediately after the transfer, or (B) a transfer of assets by the Company to: (1) a stockholder of the Company (immediately before the asset transfer) in exchange for or with respect to the Company’s stock, (2) an entity, fifty percent (50%) or more of the total value or voting power of which is owned, directly or indirectly, by the Company, (3) a Person, that owns, directly or indirectly, fifty percent (50%) or more of the total value or voting power of all the outstanding stock of the Company, or (4) an entity, at least fifty percent (50%) of the total value or voting power of which is owned, directly or indirectly, by a Person described in this subsection (iii)(B)(3).For purposes of this subsection (iii), gross fair market value means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets.

For purposes of this Section 2(f), persons will be considered to be acting as a group if they are owners of a corporation that enters into a merger, consolidation, purchase or acquisition of stock, or similar business transaction with the Company.

Notwithstanding the foregoing, a transaction will not be deemed a Change in Control unless the transaction qualifies as a change in control event within the meaning of Code Section 409A, as it has been and may be amended from time to time, and any proposed or final Treasury Regulations and Internal Revenue Service guidance that has been promulgated or may be promulgated thereunder from time to time.

| -2- |

| Table of Contents |

Further and for the avoidance of doubt, a transaction will not constitute a Change in Control if: (i) its sole purpose is to change the jurisdiction of the Company’s incorporation, or (ii) its sole purpose is to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction.

(g) “Code” means the Internal Revenue Code of 1986, as amended. Reference to a specific section of the Code or regulation thereunder shall include such section or regulation, any valid regulation promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such section or regulation.