UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934

☒ Filed by the Registrant

☐ Filed by a party other than the Registrant

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a‑12 |

| ARTELO BIOSCIENCES, INC. |

| (Name of Registrant as Specified In Its Charter) |

______________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION, DATED JULY 28, 2025

505 Lomas Santa Fe, Suite 160

Solana Beach, CA 92075

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To the Stockholders of Artelo Biosciences, Inc.:

We are pleased to invite you to attend the special meeting of stockholders of Artelo Biosciences, Inc. (the “Special Meeting”) to be held on Thursday, August 28, 2025 at 8 a.m., Pacific Time, or at any adjournment or postponement thereof, for the purposes stated herein, via internet webcast, for the following purposes:

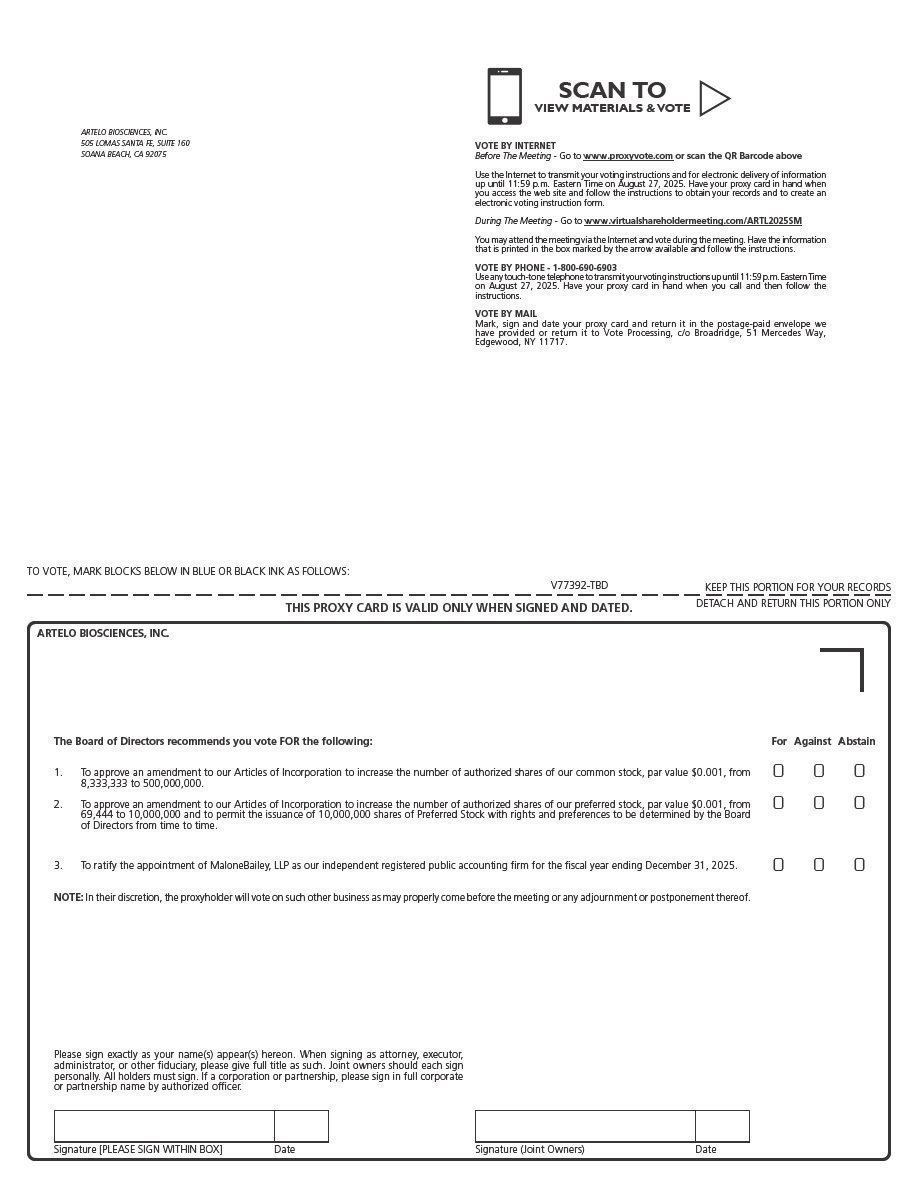

|

| 1. | To approve an amendment to our Articles of Incorporation, as amended (“Articles”), to increase the number of authorized shares of our common stock, par value $0.001 (“Common Stock”) from 8,333,333 to 500,000,000; |

|

|

|

|

|

| 2. | To approve an amendment of our Articles to increase the number of authorized shares of our preferred stock, par value $0.001 (“Preferred Stock”), from 69,444 to 10,000,000 and to permit the issuance of 10,000,000 shares of Preferred Stock with rights and preferences to be determined by the Board of Directors (the “Board”) from time to time; |

|

|

|

|

|

| 3. | Ratify the appointment of MaloneBailey, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

|

|

|

|

|

| 4. | To transact such other business as may be properly brought before the Special Meeting or any adjournments or postponements thereof. |

The Special Meeting will be a completely virtual meeting of stockholders, to be conducted via live webcast. You will be able to attend the Special Meeting virtually and vote online during the meeting by visiting www.virtualshareholdermeeting.com/ARTL2025SM. You will be able to attend and participate in the Special Meeting online, vote your shares electronically, and submit questions prior to and during the meeting. To vote at the Special Meeting, (a) if you hold your shares through a bank, broker or other nominee, then you are considered the beneficial owner of shares held in street name, and the proxy materials were forwarded to you by your broker, bank or other nominee , and (b) if you hold your shares in an account with our transfer agent, you will need the control number that is shown on your proxy card or e-mail notification of the Special Meeting.

You will not be able to attend the Special Meeting in person.

Our Board has fixed the close of business on July 25, 2025, as the record date for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting and at any adjournment or postponement thereof.

Whether or not you expect to attend the Special Meeting via live webcast, please vote at your earliest convenience. You may vote over the internet, by telephone or, if you request to receive printed proxy materials, by mailing a proxy or voting instruction card. You may also vote your shares during the Special Meeting. Submitting your proxy in advance of the Special Meeting will not prevent you from voting your shares during the Special Meeting, as your proxy is revocable at your option as described in the proxy statement accompanying this notice. Please review the instructions regarding each of your voting options described in the proxy statement, as well as in the proxy card you received by mail.

Your vote is important. Whether or not you plan to attend the meeting, please sign and submit your proxy as soon as possible so that your shares can be voted at our Special Meeting in accordance with your instructions. If you attend the meeting, you may revoke your proxy in accordance with the procedures set forth in the proxy statement. Our proxy statement, notice of special meeting, and form of proxy, is first being sent or made available on or about [●], 2025, to all stockholders as of the record date. A copy of our proxy statement and any amendments thereto, are also posted on https://www.proxyvote.com/ and are available from the SEC on its website at www.sec.gov.

|

| By Order of the Board of Directors, | ||

|

|

|

|

|

| By: |

| ||

|

|

| Gregory D. Gorgas |

|

|

|

| President and Chief Executive Officer |

|

Solana Beach, California

[●], 2025

| i |

Table of Contents

|

| Page |

| |

|

| 1 |

| |

|

| 6 |

| |

| Security Ownership of Certain Beneficial Owners and Management |

| 7 |

|

|

| 8 |

| |

|

| 11 |

| |

| Proposal 3 – Ratification of Independent Registered Public Accounting Firm |

| 14 |

|

|

| 15 |

|

| ii |

| Table of Contents |

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION, DATED JULY 28, 2025

505 Lomas Santa Fe, Suite 160

Solana Beach, CA 92075

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To be held at 8:00 a.m., Pacific time, on August 28, 2025

The Board of Directors (the “Board”) of Artelo Biosciences, Inc., a Nevada corporation (“Artelo,” “Artelo Biosciences,” “the company,” “we,” “us” or “our”) has delivered these proxy materials to you in connection with the solicitation of proxies for use at the Special Meeting of Stockholders (the “Special Meeting”). The Special Meeting will be held live via internet webcast on Thursday, August 28, 2025 at 8 a.m., Pacific Time, or at any adjournment or postponement thereof, for the purposes stated herein. These proxy materials were first sent or given on or about [●], 2025, to all stockholders as of the record date.

Proxy Materials

Our proxy statement, notice of special meeting and form of proxy are first being sent or given on or about [●], 2025, to all stockholders of record as of July 25, 2025. The proxy materials can be accessed as of [●], 2025, by visiting https://www.proxyvote.com/. In additional to mailing our proxy materials, we are providing access to our proxy materials over the Internet under the rules adopted by the U.S. Securities and Exchange Commission.

Virtual Special Meeting

We are embracing technology to provide expanded access, improved communication, reduced environmental impact and cost savings for our stockholders and the company. Hosting a virtual meeting enables increased stockholder attendance and participation since stockholders can participate and ask questions from any location around the world and provides us an opportunity to give thoughtful responses. In addition, we intend that the virtual meeting format provide stockholders a similar level of transparency to the traditional in-person meeting format, and we take steps to ensure such an experience. Our stockholders will be afforded the same opportunities to participate at the virtual Special Meeting as they would at an in-person special meeting of stockholders.

Participating in the Special Meeting

We will host the Special Meeting live via internet webcast. You will not be able to attend the Special Meeting in person. A summary of the information you need in order to attend the Special Meeting online is provided below:

|

| · | You will be able to attend the Special Meeting virtually and vote online during the meeting by visiting www.virtualshareholdermeeting.com/ARTL2025SM. |

|

|

|

|

|

| · | The live internet webcast will begin on Thursday, August 28, 2025 at 8 a.m., Pacific Time. On the day of the Special Meeting, you may enter the meeting by clicking on the link provided above and entering the control number included on your proxy card. |

|

|

|

|

|

| · | Stockholders may vote and submit questions during the Special Meeting live via the internet. |

|

|

|

|

|

| · | We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number 1-866-612-8937 or e-mail virtualmeeting@viewproxy.com. |

|

|

|

|

|

| · | Instructions regarding how to connect and participate live via the internet, including how to demonstrate proof of stock ownership, are posted at https://www.proxyvote.com/. |

| 1 |

| Table of Contents |

Voting Rights and Outstanding Shares

Only stockholders that owned our common stock at the close of business on July 25, 2025, the record date for the Special Meeting, are entitled to notice of, and to vote at, the Special Meeting. On the record date, 704,425 shares of our common stock were outstanding. Each share of our common stock that you own entitles you to one vote on each matter to be voted upon at the Special Meeting. We will have a quorum to conduct the business of the Special Meeting if the holders of at least 35% of the outstanding shares of our common stock entitled to vote are present, in person via the internet webcast or by proxy. Abstentions and broker non-votes (i.e., shares of common stock held by a broker, bank or other agent that are represented at the meeting, but which the broker, bank or other agent is not empowered to vote on a particular proposal) will be counted for purposes of determining whether a quorum is present at the Special Meeting.

Proposals for the Special Meeting

The following proposals will be voted on at the Special Meeting:

|

| · | To approve an amendment to our Articles of Incorporation, as amended (“Articles”), to increase the number of authorized shares of our common stock, par value $0.001 (“Common Stock”), from 8,333,333 to 500,000,000; |

|

|

|

|

|

| · | To approve an amendment of our Articles to increase the number of authorized shares of our preferred stock, par value $0.001 (“Preferred Stock”), from 69,444 to 10,000,000 and to permit the issuance of 10,000,000 shares of Preferred Stock with rights and preferences to be determined by the Board from time to time; |

|

|

|

|

|

| · | Ratify the appointment of MaloneBailey as our independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

|

|

|

|

|

| · | To transact such other business as may be properly brought before the Special Meeting or any adjournments or postponements thereof. |

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the Special Meeting.

Voting Requirements to Approve Each Proposal

Proposal 1 – Increase Authorized Common Stock. The proposal to amend our Articles to increase the number of authorized shares of Common Stock from 8,333,333 to 500,000,000, must be approved by a vote of a majority of the total votes cast via the internet or represented by proxy at the special meeting. Abstentions and Broker non-votes will have no effect on the outcome of this proposal. This proposal is considered a routine or “discretionary” matter on which your broker, bank or other agent will be able to vote on your behalf even if it does not receive instructions from you.

Proposal 2 – Increase Authorized Preferred Stock. The proposal to amend our Articles to increase the number of authorized shares of Preferred Stock from 69,444 to 10,000,000 and to permit the issuance of 10,000,000 shares of Preferred Stock with rights and preferences to be determined by the Board from time to time, requires an affirmative vote of at least a majority of the outstanding shares of Common Stock. Abstentions and Broker non-votes will have the same effect as a vote “AGAINST” this proposal.

Proposal 3 – Ratification of the Appointment of MaloneBailey. The proposal to ratify the appointment of MaloneBailey as our independent registered public accounting firm for the fiscal year ending December 31, 2025, must be approved by a vote of a majority of the total votes cast via the internet or represented by proxy at the special meeting. Abstentions and Broker non-votes will have no effect on the outcome of this proposal. This proposal is considered a routine or “discretionary” matter on which your broker, bank or other agent will be able to vote on your behalf even if it does not receive instructions from you.

| 2 |

| Table of Contents |

Voting Shares Registered in Your Name

If you are a stockholder of record, you may vote in one of four ways:

|

| · | Vote via the internet. You may submit a proxy over the Internet at https://www.proxyvote.com/ 24 hours a day, seven days a week. You will need the control number included on your proxy card or mail notification about the Special Meeting; |

|

|

|

|

|

| · | Vote by telephone. You may submit a proxy using a touch-tone telephone by calling 1‑866‑804‑9616, 24 hours a day, seven days a week. You will need the control number included on your proxy card or email notification about the Special Meeting; |

|

|

|

|

|

| · | Vote by Mail. If you received printed proxy materials, you may direct how your shares are voted at the Special Meeting by completing, signing, and dating each proxy card received and returning it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. Your completed, signed and dated proxy card must be received prior to the Special Meeting; or |

|

|

|

|

|

| · | Vote during the Special Meeting live via the internet by following the instructions posted at https://www.proxyvote.com/. |

Votes submitted via the internet or by telephone must be received by 11:59 p.m., Eastern Time, on August 27, 2025. Submitting your proxy via the internet, by telephone or by mail will not affect your right to vote during the Special Meeting live via the internet. For additional information, please see “Revocability of Proxies” below.

Voting Shares Registered in the Name of a Broker, Bank or Other Agent

Most beneficial owners holding stock in “street name” will receive instructions for voting their shares from their broker, bank or other agent. A number of brokers and banks participate in a program provided through Broadridge Financial Solutions, Inc. (“Broadridge”) that allows stockholders to grant their proxy to vote shares by means of the telephone or internet. If your shares are held in an account with a broker or bank participating in the Broadridge program, you may vote by telephone by calling the number shown on the voting instruction form received from your broker or bank, or you may vote via the internet at Broadridge’s website at http://www.proxyvote.com/, using the control number provided by your broker, bank or other agent. However, since you are not the stockholder of record, you may not vote your shares at the Special Meeting live via the internet unless you direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you.

Revocability of Proxies

If you are a stockholder of record, once you have submitted your proxy by mail, telephone or internet, you may revoke it at any time before it is voted at the Special Meeting. You may revoke your proxy in any one of the following three ways:

|

| · | You may submit another proxy marked with a later date (which automatically revokes your earlier proxy) by mail or telephone or via the internet by the applicable deadline as described above; |

|

|

|

|

|

| · | You may provide written notice that you wish to revoke your proxy to our Secretary at Artelo Biosciences, Inc., Attn: Secretary, 505 Lomas Santa Fe, Suite 160, Solana Beach, CA 92075 by no later than the close of business on Wednesday, August 28, 2025; or |

|

|

|

|

|

| · | You may attend the Special Meeting and submit your vote live via the internet. Attendance at the Special Meeting live via the internet will not, by itself, cause your previously granted proxy to be revoked. |

If you are a beneficial owner holding shares in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other agent in accordance with the instructions they provided (see “Voting Shares Registered in the Name of a Broker, Bank or Other Agent” above).

| 3 |

| Table of Contents |

Tabulation of Votes

A representative from Broadridge will act as inspector of elections and tabulate the votes at the Special Meeting. All shares represented by valid proxies received before the Special Meeting will be voted. If you submit a valid proxy containing instructions regarding how to vote with respect to any matter to be acted upon, your shares will be voted in accordance with those instructions. If you submit a valid proxy with no instructions, then your shares will be voted by the individuals we have designated as proxies for the Special Meeting in the following manner:

|

| · | “FOR” the approval of an amendment to our Articles to increase the number of authorized shares of our Common Stock from 8,333,333 to 500,000,000; |

|

|

|

|

|

| · | “FOR” the approval of an amendment of our Articles to increase the number of authorized shares of our Preferred Stock from 69,444 to 10,000,000 and to permit the issuance of 10,000,000 shares of Preferred Stock with rights and preferences to be determined by the Board from time to time; and |

|

|

|

|

|

| · | “FOR” the ratification of the appointment of MaloneBailey as our independent registered public accounting firm for our fiscal year ending December 31, 2025. |

In addition, the individuals that we have designated as proxies for the Special Meeting will have discretionary authority to vote your shares with respect to any other business that may properly come before the Special Meeting or any adjournment or postponement thereof.

Voting Results

Preliminary voting results are expected to be announced at the Special Meeting. Voting results will be tallied by the inspector of elections and reported in a Current Report on Form 8-K (the “Form 8-K”) that we will file with the SEC within four business days of the Special Meeting. If the voting results reported in the Form 8-K are preliminary, we will subsequently file an amendment to the Form 8-K to report the final voting results within four business days of the date on which the final voting results are known.

Proxy Solicitation

This proxy solicitation is made by the Board and we will bear the entire cost of soliciting proxies for the Special Meeting, including costs associated with the preparation, assembly, printing and mailing of the proxy materials and any additional information furnished to stockholders. We will make available copies of the proxy materials to brokers, banks and other agents holding shares of our common stock in their name for the benefit of others for forwarding to the beneficial owners. We may reimburse such brokers, banks or other agents for their costs associated with forwarding the proxy materials to the beneficial owners. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

Householding of Proxy Materials

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the proxy statement, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the proxy statement to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of future mailings to stockholders at the shared address, you may contact us as follows:

Artelo Biosciences, Inc.

Attention: Investor Relations

505 Lomas Santa Fe, Suite 160

Solana Beach, CA 92075

Tel: (858) 925-7049

| 4 |

| Table of Contents |

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

Stockholder Proposals for the 2025 Special Meeting of Stockholders or Director Nominations for the 2025 Annual Meeting of Stockholders

If a stockholder would like us to consider including a proposal in our proxy statement for our 2025 special meeting of stockholders pursuant to Rule 14a-8 of the Exchange Act, then the proposal must be received by our secretary at our principal executive offices on or before July 11, 2025. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to:

Artelo Biosciences, Inc.

Attention: Secretary

505 Lomas Santa Fe, Suite 160

Solana Beach, CA 92075

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal or nominate a director at an annual meeting, but do not seek to include the proposal or director nominee in our proxy statement. In order to be properly brought before our 2025 annual meeting, the stockholder must provide timely written notice to our secretary, at our principal executive offices, and any such proposal or nomination must constitute a proper matter for stockholder action. The written notice must contain the information specified in our bylaws. To be timely, a stockholder’s written notice must be received by our secretary at our principal executive offices:

|

| · | no earlier than 8:00 a.m., Eastern time, on August 22, 2025, and |

|

| · | no later than 5:00 p.m., Eastern time, on September 19, 2025. |

In the event that we hold our 2025 annual meeting more than 25 days after the one-year anniversary of this year’s annual meeting, then such written notice must be received by our secretary at our principal executive offices:

|

| · | no earlier than 8:00 a.m., Eastern time, on the 120th day prior to the day of our 2025 annual meeting, and |

|

| · | no later than 5:00 p.m., Eastern time, on the later of the 90th day prior to the day of the annual meeting or, if the first public announcement of the date of such annual meeting is less than 100 days prior to the date of such annual meeting, the 10th day following the day on which public announcement of the date of the annual meeting was first made by us. |

In addition to satisfying the requirements of our bylaws, including the earlier notice deadlines set forth above and therein, to comply with universal proxy rules, stockholders who intend to solicit proxies in support of director nominees (other than our nominees) must also provide notice that sets forth the information required by Rule 14a-19 of the Exchange Act, no later than October 21, 2025.

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting of stockholders does not present his, her or its proposal at such annual meeting, then we are not required to present the proposal for a vote at such annual meeting.

| 5 |

| Table of Contents |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

The Board knows of no matters to come before the special meeting other than the matter referred to in this Proxy Statement. However, if any other matters should properly come before the meeting, the persons named in the enclosed proxy intend to vote in accordance with their best judgment. None of our directors, executive officers, any person who has served as a director or executive officer since the beginning of the last fiscal year, or their associates, has any interest, direct or indirect, by security holdings or otherwise, in the matter to be acted upon at the special meeting as described in this Proxy Statement that is not shared by all of our other stockholders.

| 6 |

| Table of Contents |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information with respect to the beneficial ownership of our common stock as of July 25, 2025, by (i) each person we know to be the beneficial owner of 5% or more of our outstanding shares of common stock, (ii) each named executive officer and our directors and (iii) all executive officers and directors as a group. Information with respect to beneficial ownership is based on a review of our corporate and stock transfer records and on Schedules 13D and 13G# that have been filed with the SEC by or on behalf of the stockholders listed below. Except as indicated by the footnotes below, we believe, based on the information available to us, that the persons named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

Percentage of beneficial ownership is calculated based on 704,425 shares of common stock outstanding on July 25, 2025. We have determined beneficial ownership in accordance with SEC rules. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed as outstanding shares of common stock subject to stock options held by that person that are currently exercisable or exercisable within 60 days of July 25, 2025. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Except otherwise indicated in the footnotes below, the address of each beneficial owner listed in the table is Artelo Biosciences, Inc., 505 Lomas Santa Fe, Suite 160, Solana Beach, CA 92075.

|

|

| Number of |

|

| Number of Shares Subject to Options Exercisable |

|

| Total Shares Beneficially Owned | |||||||

| Name and Address of Beneficial Owner |

| Shares Held |

|

| within 60 Days |

|

| Number |

|

| % | ||||

| Directors and Named Executive Officers |

|

|

|

|

|

|

|

|

|

|

| ||||

| Gregory D. Gorgas(1) |

|

| 3,407 |

|

|

| 30,160 |

|

|

| 33,567 |

|

| 4.8 | % |

| Connie Matsui(2) |

|

| 629 |

|

|

| 1,357 |

|

|

| 1,986 |

|

| * | |

| Steven Kelly(3) |

|

| 139 |

|

|

| 1,240 |

|

|

| 1,379 |

|

| * | |

| Douglas Blayney, M.D. (4) |

|

| 139 |

|

|

| 1,189 |

|

|

| 1,328 |

|

| * | |

| R. Martin Emanuele, Ph.D.(5) |

|

| 139 |

|

|

| 1,152 |

|

|

| 1,291 |

|

| * | |

| Gregory R. Reyes M.D., Ph.D. (6) |

|

| - |

|

|

| 935 |

|

|

| 935 |

|

| * | |

| Tamara A. (Seymour) Favorito (7) |

|

| - |

|

|

| 452 |

|

|

| 452 |

|

| * | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| All Current Directors and Executive Officers as a Group (7 persons) (8) |

|

| 4,453 |

|

|

| 36,485 |

|

|

| 40,938 |

|

| 5.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| 5% Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| None |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

______________

| * | Less than one percent. |

| (1) | Consists of (i) 3,007 shares held directly by Gregory D. Gorgas and 400 shares held indirectly by Gorgas Family Trust, and (ii) 30,160 shares of Common Stock issuable pursuant to options held directly by Gregory D. Gorgas exercisable within 60 days of July 25, 2025. |

| (2) | Consists of (i) 629 shares held directly by Connie Matsui (ii) 1,357 shares of Common Stock issuable pursuant to options held directly by Connie Matsui exercisable within 60 days of July 25, 2025. |

| (3) | Consists of (i) 139 shares held by Steven Kelly, and (ii) 1,240 shares of Common Stock issuable pursuant to options held directly by Steven Kelly exercisable within 60 days of July 25, 2025 |

| (4) | Consists of (i) 139 shares held by Douglas Blayney, M.D., and (ii) 1,189 shares of Common Stock issuable pursuant to options held directly by Douglas Blayney, M.D. exercisable within 60 days of July 25, 2025. |

| (5) | Consists of (i) 139 shares held by R. Marty Emanuele, Ph.D., and (ii) 1,152 shares of Common Stock issuable pursuant to options held directly by R. Marty Emanuele, Ph.D. exercisable within 60 days of July 25, 2025. |

| (6) | Consists of 935 shares of Common Stock issuable pursuant to options held directly by Gregory R. Reyes M.D., Ph.D. exercisable within 60 days of July 25, 2025. |

| (7) | Consists of 452 shares of Common Stock issuable pursuant to options held directly by Tamara A. Favorito exercisable within 60 days of July 25, 2025. |

| (8) | Includes 36,485 shares of Common Stock subject to options exercisable within 60 days of July 25, 2025. |

| 7 |

| Table of Contents |

TO APPROVE AN AMENDMENT TO OUR ARTICLES OF INCORPORATION, AS AMENDED, TO INCREASE THE AUTHORIZED NUMBER OF SHARES OF OUR COMMON STOCK FROM 8,333,333 TO 500,000,000

General

Our Board has unanimously adopted a resolution approving an amendment to our Articles to increase the authorized number of shares of common stock from 8,333,333 shares to 500,000,000 shares, par value of $0.001 per share (the “Increase Shares Amendment”). Approval of the Increase Shares Amendment will grant the Board the authority, without further action by the stockholders, to carry out the amendment to the Articles after the date of stockholder approval for the Increase Shares Amendment.

Our Board has determined that it is advisable to increase the authorized number of shares of our common stock from 8,333,333 to 500,000,000 and recommends that our stockholders approve the Increase Shares Amendment to effect the proposed increase. The full text of the proposed amendment to our Articles is attached to this Proxy Statement as Appendix A. However, the text of the proposed amendment is subject to revision to include such changes as may be required by the Secretary of State of the State of Nevada and as our Board deems necessary and advisable to effect the proposed Increase Shares Amendment. If approved by our stockholders, we intend to file the Increase Shares Amendment with the Secretary of State of Nevada as soon as practicable following the Special Meeting, and such amendment will be effective upon filing. If this proposal is not approved by our stockholders, our Articles will continue as currently in effect.

Purpose of the Increase in Authorized Shares

As of July 25, 2025, we had 8,333,333 authorized shares of common stock, $0.001 par value per share, of which 704,425 shares were issued and outstanding. Of the remaining 7,628,908 authorized shares of common stock, 899,744 shares are reserved for issuance upon the exercise of issued and outstanding warrants, 128,976 shares are reserved for issuance upon the exercise of issued and outstanding equity awards and 206,588 shares are reserved for future issuance under our existing stock incentive plans.

On May 22, 2025, we received a notice (the “May Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) notifying us that we are not in compliance with Nasdaq Listing Rule 5550(b)(1), which requires companies listed on The Nasdaq Capital Market to maintain a minimum of $2,500,000 in stockholders’ equity for continued listing. In our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025, we reported stockholders’ equity of $652,000, and, as a result, does not currently satisfy Nasdaq Listing Rule 5550(b)(1) (the “Stockholders’ Equity Requirement”). Pursuant to the May Notice, we submitted a plan to regain compliance on July 7, 2025, which included certain proposed actions to be taken by us to explore additional sources of income, to increase its stockholders’ equity through additional capital raises and/or equity lines of credit as needed, and requesting an extension through November 18, 2025, which is 180 days from the date of the Stockholders’ Equity Notice to regain compliance of the Stockholders’ Equity Requirement. In the event the plan is not accepted by Nasdaq, or in the event the plan is accepted by Nasdaq and the 180-day extension period is granted, but we fail to regain compliance within such plan period, we would have the right to a hearing before an independent panel. The hearing request would stay any suspension or delisting action pending the conclusion of the hearing process and the expiration of any additional extension period granted by the panel following the hearing. In efforts to regain compliance under the Nasdaq Listing Rules and to remain listed on Nasdaq, we are currently exploring financing opportunities available to us.

Our Board believes it is in the best interest of the company to increase the number of authorized shares of our common stock to give us greater flexibility in considering and planning for imminent and future potential business needs, including but not limited to public offerings or private placements of our common stock and other securities for capital raising purposes and issuances of our common stock in connection with collaborations, other strategic transactions or other general corporate transactions. Increasing the authorized number of shares of our common stock will give us greater flexibility and will allow us to issue such shares in most cases without the expense of delay of seeking stockholder approval. Moreover, the additional authorized shares available will also help to provide appropriate equity incentives to assist in the recruitment and retention of employees.

| 8 |

| Table of Contents |

We do not currently have any definitive agreements or arrangements to issue any of the proposed additional authorized shares of common stock that will become available for issuance if this proposal is approved and the proposed amendment is effected. However, we are at all times investigating additional sources of financing which our Board believes will be in our best interests and in the best interests of our stockholders. We are and will opportunistically consider raising funds in the future based on market conditions and our business objectives and needs. The Board believes that additional authorized shares of Common Stock will enable us to take timely advantage of market conditions and financing opportunities that become available to us. Except as otherwise required by law or by regulation, the newly authorized shares of Common Stock will be available for issuance at the discretion of the Board (without further action by the stockholders) for various future corporate needs, including those outlined above. While adoption of the proposed amendment would not have any immediate dilutive effect on the proportionate voting power or other rights of our existing stockholders, any future issuance of additional authorized shares of our Common Stock may, among other things, dilute the earnings per share of the common stock and the equity and voting rights of those holding common stock at the time the additional shares are issued.

Rights of Additional Authorized Shares

The proposed Increase Shares Amendment will not have any effect on the par value per share of our common stock. Our Common Stock is a single class, with equal voting, distribution, liquidation and other rights. The additional Common Stock to be authorized by the proposed amendment would have rights identical to our currently outstanding common stock. If our Board issues additional shares of common stock, existing stockholders would not have any preferential rights to purchase any newly authorized shares of common stock solely by virtue of their ownership of shares of our common stock, and their percentage ownership of our then outstanding common stock could be reduced. The issuance of additional shares of common stock could have the effect of diluting existing stockholder earnings per share, book value per share and voting power.

Potential Anti-Takeover Effects

Due to the volatility of our common stock, the Board has discussed various measures that we can take, including a shareholder rights plan and the use of blank check preferred, as described in Proposal 2, to deal with potential threats of hostile takeovers. However, the proposal to increase in the number of authorized shares of common stock was not done with the purpose or intention of using the additional authorized shares for anti-takeover purposes, such as to oppose a hostile takeover attempt or to delay or prevent a change in control of the company that our Board does not support, however we could use the additional shares for such purpose. Although the proposal to increase the authorized common stock has not been prompted by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at us), nevertheless, stockholders should be aware that the Increase Shares Amendment could facilitate future efforts by us to deter or prevent changes in control of the company, including transactions in which stockholders of the company might otherwise receive a premium for their shares over then current market prices. However, the Board has a fiduciary duty to act in the best interests of our stockholders at all times.

The proposed amendment, if effected, will increase the number of authorized but unissued shares of our common stock, and, subject to compliance with law and the listing rules of the Nasdaq, our Board could issue, without further stockholder approval, the additional shares available for issuance as result of such increase in one or more transactions that could make it more difficult for a party to effect a takeover or change in control of the company that our Board does not support. For example, our Board could issue additional shares without further stockholder approval (subject to compliance with law and the listing rules of the Nasdaq) so as to dilute the stock ownership or voting rights of persons seeking to obtain control of our Board or of the company in a transaction that our Board does not support, including in a transaction in which a person is offering a premium to our stockholders for their shares of our common stock over then current market prices. The proposed Amendment has been prompted by business and financial considerations described above under the header, “Purpose of the Increase in Authorized Shares.” and not by the threat of any known or threatened hostile takeover attempt, however, stockholders should be aware that by potentially discouraging initiation of any such unsolicited takeover attempts, the proposed amendment may limit the opportunity for our stockholders to receive a premium for their shares over then current market prices generally available in such takeover attempts. Additionally, the issuance of additional shares of common stock could have the effect of diluting existing stockholder earnings per share, book value per share and voting power.

Risks of Not Approving This Proposal

If the stockholders do not approve this proposal, we will continue to have 8,333,333 authorized shares of common stock. This could adversely impact our ability to raise necessary funds to meet Nasdaq’s Stockholders’ Equity Requirement, to operate and continue business and to pursue opportunities in which shares of our common stock could be issued that our Board may determine would otherwise be in the best interest of the company and our stockholders, including financing and strategic transaction opportunities and employee recruitment and retention purposes, as described above under the header, “Purpose of the Increase in Authorized Shares.”

| 9 |

| Table of Contents |

No Dissenters’ or Appraisal Rights

Under the Nevada Revised Statutes, our stockholders are not entitled to dissenters’ or appraisal rights with respect to the proposed increase in authorized shares and the change to our Articles and we will not independently provide our stockholders with any such rights.

Required Vote

The Increase Shares Amendment will be approved by our stockholders if a majority of the outstanding shares of our common stock vote “FOR” this proposal. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. Abstentions and Broker non-votes will have no effect on the outcome of this proposal. This proposal is considered a routine or “discretionary” matter on which your broker, bank or other agent will be able to vote on your behalf even if it does not receive instructions from you.

Board Recommendation

Our Board unanimously recommends a vote “FOR” approval of an amendment to our Articles to increase the authorized number of shares of our common stock from 8,333,333 to 500,000,000, as further described above.

| 10 |

| Table of Contents |

TO APPROVE THE AMENDMENT OF OUR ARTICLES OF INCORPORATION, AS AMENDED, TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF PREFERRED STOCK FROM 69,444 TO 10,000,000 AND TO PERMIT THE ISSUANCE OF 10,000,000 SHARES OF PREFERRED STOCK WITH RIGHTS AND PREFERENCES TO BE DETERMINED BY THE BOARD FROM TIME TO TIME

General

Our Board has unanimously adopted a resolution approving an amendment to the Articles in order to increase the number of authorized shares of Preferred Stock from 69,444 to 10,000,000 and to authorize the issuance of 10,000,000 shares of Preferred Stock with rights and preferences to be determined by the Board from time to time (the “Blank Check Preferred Amendment”). The Approval of the Blank Check Preferred Amendment will grant the Board the authority, without further action by the stockholders, to carry out the amendment to the Articles after the date stockholder approval for the Blank Check Preferred Amendment. The Board believes that by granting the Board the authority to designate the rights and preferences of series of preferred stock would give us greater flexibility and allow us to issue such shares in most cases without the expense of delay of seeking stockholder approval. We are at all times investigating additional sources of financing which our Board believes will be in our best interests and in the best interests of our stockholders. The proposed Blank Check Preferred Amendment would increase the number of the currently authorized number of shares of preferred stock in our Articles from 69,444 to 10,000,000.

Our Articles currently have 69,444 shares of preferred stock authorized of which none are issued and outstanding. Our Board has determined that it is advisable to amend the Articles to increase the number of authorized shares of preferred stock from 69,444 to 10,000,000 and to allow the Board the right to determine the rights and preferences of the preferred stock in its discretion to provide flexibility with its capital raising efforts. The full text of the proposed amendment to our Articles is attached to this proxy statement as Appendix B. However, the text of the proposed amendment is subject to revision to include such changes as may be required by the Secretary of State of the State of Nevada and as our Board deems necessary and advisable to effect the proposed Blank Check Preferred Amendment. If approved by our stockholders, we intend to file the Blank Check Preferred Amendment with the Secretary of State of Nevada as soon as practicable following the Special Meeting, and such amendment will be effective upon filing. If this proposal is not approved by our stockholders, our Articles will continue as currently in effect.

Purpose of the Blank Check Preferred

We are requesting our stockholders to approve and adopt an amendment to Articles in order to authorize the issuance of 10,000,000 shares of preferred stock, with rights and preferences to be determined by the Board from time to time. The Board believes that the adoption the Blank Check Preferred Amendment will provide maximum financial and strategic flexibility with respect to future financing transactions. The Board believes that having Blank Check Preferred stock will be attractive for investors and could be used as a means of raising capital, where the terms of those securities being negotiated and tailored to meet the needs of both investors and the company. If the Blank Check Preferred Amendment is approved, the Board could issue up to a total of 10,000,000 shares of preferred stock in one or more series. The Board would be able to establish the number of shares to be included in each such series and issue the additional shares of authorized preferred stock with such designations, preferences and relative, participating, optional, conversion or other special rights (if any) of such series and the qualifications, limitations or restrictions (if any) thereof, as the Board may in the future establish by resolution(s). No vote of the holders of our common stock or preferred stock would be required for the creation or issuance of a series of preferred stock, unless otherwise expressly required by the Articles, the preferred stock designation creating any series of preferred Stock, or to the extent required by the Nevada Revised Statutes or Nasdaq (“Required Approval”). The Board could authorize the issuance of preferred stock with voting or conversion rights that could dilute the voting power or rights of the holders of common stock. In addition, the issuance of preferred stock could, among other things, have the effect of delaying, deferring or preventing a change in control of the company and might harm the market price of our Common Stock.

| 11 |

| Table of Contents |

Rights of Blank Check Preferred Stock

The proposed Blank Check Preferred Amendment will not have any effect on the par value per share of our preferred stock. However, the creation of a series of preferred stock and issuance of such shares of preferred stock will affect holders of our common stock. We currently only have one class of stock, Common Stock issued and outstanding. All of the holders of Common Stock have the same rights. As discussed above, if the Blank Check Preferred Amendment is approved by the stockholders, the Board will have the power and discretion to specify the rights, preferences and restrictions of series of preferred stock, subject to any Required Approval. Such rights associated with the preferred stock will not be identical to the rights associated with our common stock. If our Board issues shares of preferred stock, existing stockholders of common stock will not have any preferential rights to purchase any newly authorized shares of preferred stock solely by virtue of their ownership of shares of our common stock. In addition, the rights of holders of preferred shares may be superior to the rights of holders of our common stock. Holders of preferred stock will be entitled to receive, when, as, and if declared by our Board, the dividends, whether cash or in-kind or in shares of additional securities of the company, at the rates and on the dates established by such series of preferred stock. Dividend rates may be fixed or variable or both. Different series of preferred stock may be entitled to dividends at different dividend rates or based upon different methods of determination. The Board could authorize the issuance of preferred stock with voting or conversion rights that are superior to the rights of holders of common stock and issuance of such preferred stock could dilute the voting power or rights of the holders of common stock. The particular terms of any series of preferred stock may among others terms include the following which is not an exhaustive list:

|

| · | the number of shares of the preferred stock being designated; |

|

|

|

|

|

| · | the title and liquidation preference per share of the preferred stock; |

|

|

|

|

|

| · | the purchase price of the preferred stock; |

|

|

|

|

|

| · | the dividend rate or method for determining the dividend rate; |

|

|

|

|

|

| · | the dates on which dividends will be paid; |

|

|

|

|

|

| · | whether dividends on the preferred stock will be cumulative or noncumulative and, if cumulative, the dates from which dividends shall commence to accumulate; |

|

|

|

|

|

| · | any redemption or sinking fund provisions applicable to the preferred stock; |

|

|

|

|

|

| · | designation of voting rights that may be senior or superior to those of held by holders of common stock; and/or |

|

|

|

|

|

| · | any additional dividend, liquidation, redemption, sinking fund, ant-dilution rights, conversion rights, rights to participate in future financings, protective rights and other rights, restrictions and terms applicable to the preferred stock |

Impact on Holders of Common Stock

While the ability of the Board to issue shares of Blank Check Preferred stock cannot be precisely determined unless and until the Board designates the rights, privileges, and preferences to attach to some or all of the authorized shares of Blank Check Preferred stock, it is likely that any series of preferred stock so designated will have one or more material features that are superior to our shares of common stock. There are not currently any agreements of the company pursuant to which the Board would authorize and issue preferred stock and there are not currently any plans, discussions or negotiations to do so.

Effects of Blank Check Preferred Amendment

Due to the volatility of our common stock, the Board has discussed various measures that we can take, including a shareholder rights plan and the use of blank check preferred, to deal with potential threats of hostile takeovers. However, the proposal for the Blank Check Preferred Amendment was not done with the purpose or intention of using such shares for anti-takeover purposes, such as to oppose a hostile takeover attempt or to delay or prevent a change in control of the company that our Board does not support, however we could use the blank preferred shares for such purpose. Although the proposal to authorize the blank check preferred stock has not been prompted by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at the company), nevertheless, stockholders should be aware that the Blank Check Preferred Amendment could facilitate future efforts by us to deter or prevent changes in control of the company, including transactions in which stockholders of the company might otherwise receive a premium for their shares over then current market prices. However, the Board has a fiduciary duty to act in the best interests of our stockholders at all times.

| 12 |

| Table of Contents |

Although the Blank Check Preferred Amendment is not motivated by anti-takeover concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of preferred stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the company more difficult or time-consuming. For example, shares of preferred stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board determines is not in the best interests of our stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of the company. Such shares of preferred stock could also be granted super-voting rights that could further inhibit the ability of a person seeking to obtain control of the company. In certain circumstances, the issuance of preferred stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the company, may discourage bids for our common stock at a premium over the prevailing market price and may adversely affect the market price of our common stock. As a result, the issuance of preferred stock could render more difficult and less likely a hostile takeover of the company by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management. We are not aware of any proposed attempt to take over the company or of any present attempt to acquire a large block of our common stock. We do not have any present intention to issue preferred stock or to use the issuance of preferred stock as an anti-takeover mechanism.

Risks of Not Approving This Proposal

If the stockholders do not approve this proposal, we will continue to have 69,444 authorized shares of preferred stock. The Board will not be able to establish the number of shares to be included in each such series and issue the additional shares of authorized preferred stock with such designations, preferences and relative, participating, optional, conversion or other special rights (if any) of such series and the qualifications, limitations or restrictions (if any) thereof, without stockholder approval. This could adversely impact our ability to raise necessary funds to meet Nasdaq’s Stockholders’ Equity Requirement, or to operate and continue business and to pursue opportunities in which shares of our preferred stock could be issued that our Board may determine would otherwise be in the best interest of the company and our stockholders, including financing and strategic transaction opportunities, as described above under the header, “Purpose of the Blank Check Preferred Amendment.”

No Dissenters’ or Appraisal Rights

Under the Nevada Revised Statutes, our stockholders are not entitled to dissenters’ or appraisal rights with respect to the proposed Blank Check Preferred Amendment and the change to our Articles and we will not independently provide our stockholders with any such rights.

Required Vote

The Increase Shares Amendment will be approved by our stockholders if a majority of the outstanding shares of our common stock vote “FOR” this proposal. You may vote “FOR,” “AGAINST” or “ABSTAIN” from voting on this proposal. Abstentions and broker non-votes will have the same effect as an “AGAINST” vote on this proposal.

Board Recommendation

Our Board unanimously recommends a vote “FOR” approval of an amendment to our Articles to increase the Preferred Stock from 69,444 to 10,000,000 and permit the issuance of 10,000,000 shares of Preferred Stock with rights and preferences to be determined by the board from time to time, as further described above.

| 13 |

| Table of Contents |

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We are asking you to ratify the appointment of MaloneBailey as our independent registered public accounting firm for the year ending December 31, 2025. MaloneBailey served as our independent registered public accounting firm for the fiscal year ended December 31, 2024. Representatives of MaloneBailey are expected to be present live via the internet at the Special Meeting, will have an opportunity to make a statement should they desire to do so.

Although our bylaws do not require that our stockholders approve the appointment of our independent registered public accounting firm, the Board is submitting the selection of MaloneBailey to our stockholders for ratification as a matter of good corporate practice. If our stockholders vote against the ratification of MaloneBailey, the Audit Committee will reconsider whether to continue to retain the firm. Even if our stockholders ratify the appointment of MaloneBailey, the Audit Committee may choose to appoint a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the company and our stockholders.

Independent Registered Public Accounting Firm Fees and Services

The following table presents fees for professional audit and other services rendered by MaloneBailey for the audit of our annual consolidated financial statements as of and for years ended December 31, 2024, and 2023, respectively, and fees billed for other services rendered by MaloneBailey during those respective periods.

| Fee Category |

| Year ended December 31, 2024 |

|

| Year ended December 31, 2023 |

| ||

|

|

|

|

|

|

|

| ||

| Audit Fees |

| $ | 123,593 |

|

| $ | 114,330 |

|

| Audit-Related Fees |

|

| 4,120 |

|

|

| 7,210 |

|

| Tax Fees |

|

| 7,725 |

|

|

| 3,245 |

|

| All Other Fees |

|

| - |

|

|

| - |

|

| Total Fees |

| $ | 135,438 |

|

| $ | 124,785 |

|

Our audit committee pre-approves all services provided by our independent auditors. All of the above services and fees were reviewed and approved by the audit committee either before or after the respective services were rendered.

Our Board has considered the nature and amount of fees billed by our independent auditors and believes that the provision of services for activities unrelated to the audit is compatible with maintaining our independent auditors’ independence.

Required Vote

Ratification of MaloneBailey as our independent registered public accounting firm for the year ending December 31, 2025, requires the affirmative “FOR” vote of a majority of the total votes cast live via the internet or represented by proxy at the Special Meeting and entitled to vote on the proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and Broker non-votes will have no effect on the outcome of this proposal. This proposal is considered a routine or “discretionary” matter on which your broker, bank or other agent will be able to vote on your behalf even if it does not receive instructions from you.

Board Recommendation

The Board unanimously recommends a vote “FOR” the ratification of MaloneBailey as our independent registered public accountant firm for the fiscal year ending December 31, 2025.

| 14 |

| Table of Contents |

SEC Filings

We know of no other matters to be submitted at the Special Meeting. If any other matters are properly brought before the Special Meeting, it is the intention of the individuals we have designated as proxies to vote the shares that they represent on such matters in accordance with their judgment.

We are subject to the informational requirements of the Exchange Act and, therefore, we file annual, quarterly, and current reports, proxy statements, and other information with the SEC. Our SEC filings are available to the public on the SEC’s website at www.sec.gov or on our website at www.artelobio.com under “Investor – SEC Filings.” You may also obtain a copy of any of our SEC filings by sending a written request to Artelo Biosciences, Inc., Attn: Investor Relations, 505 Lomas Santa Fe, Suite 160, Solana Beach, CA 92075.

|

| By order of the Board of Directors, | ||

|

|

|

|

|

| Dated: [●], 2025 | By: | ||

|

|

| Gregory D. Gorgas |

|

|

|

| President and Chief Executive Officer |

|

| 15 |

| Table of Contents |

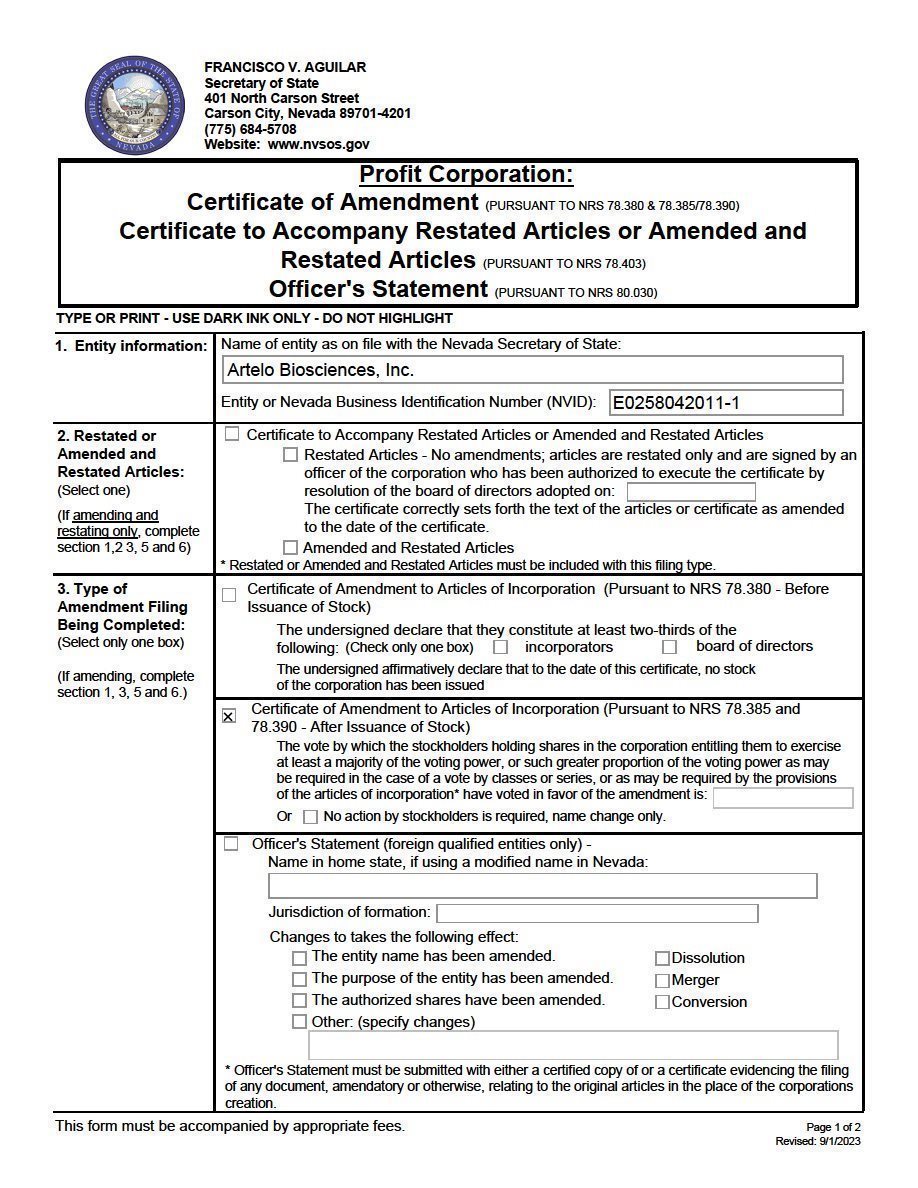

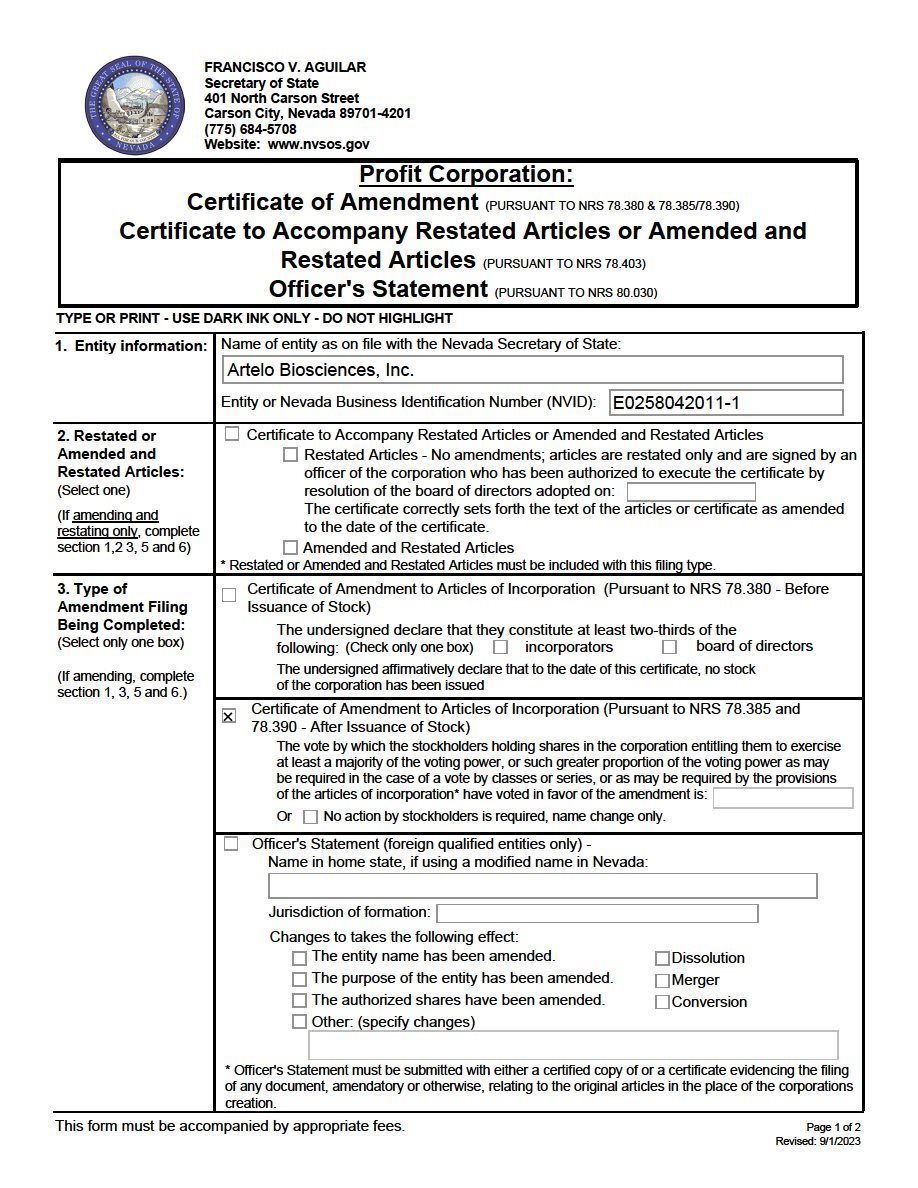

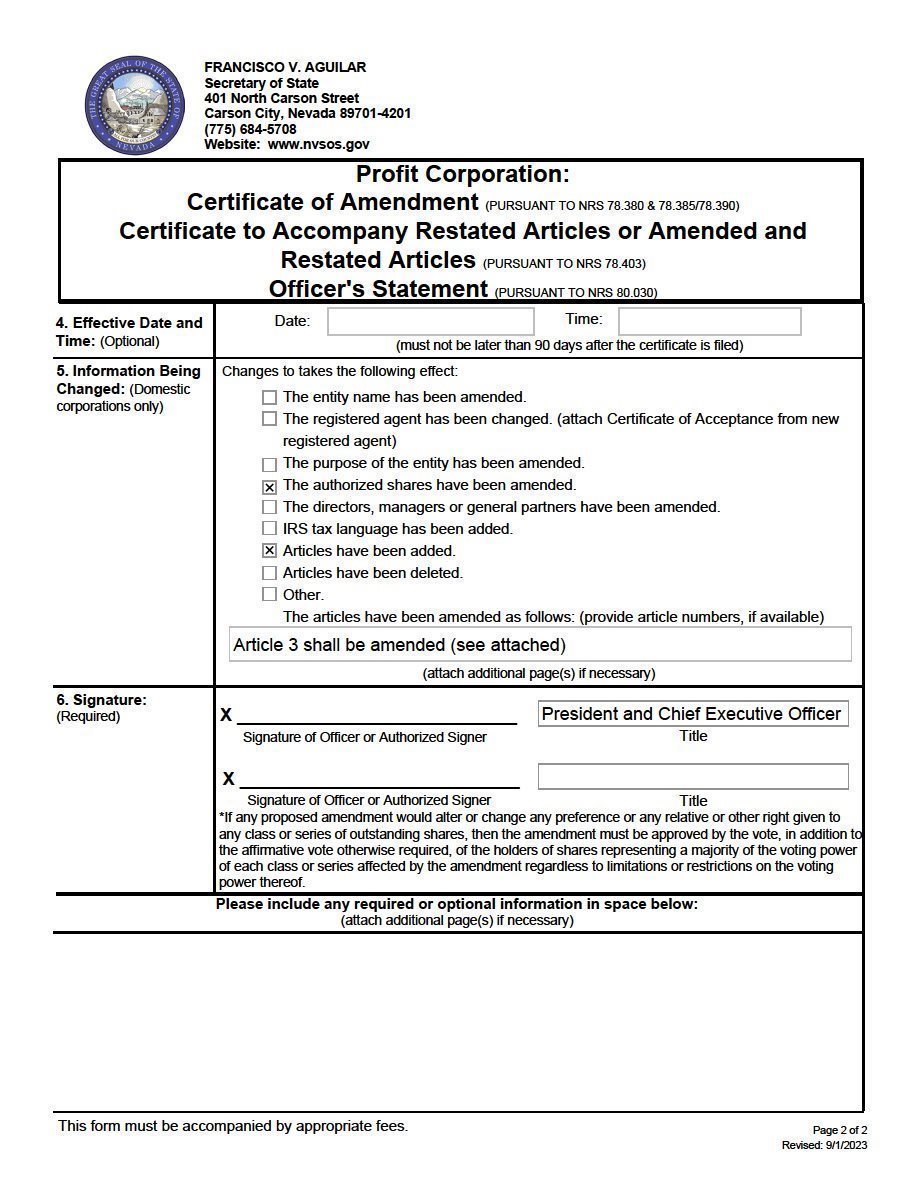

ANNEX A

AMENDMENT OF ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK

| A-1 |

| A-2 |

ANNEX B

AMENDMENT OF ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF PREFERRED STOCK

| B-1 |

| B-2 |

ATTACHMENT

TO

CERTIFICATE OF AMENDMENT TO ARTICLES OF INCORPORATION

OF

ARTELO BIOSCIENCES, INC.

ENTITY NUMBER E0258042011-1

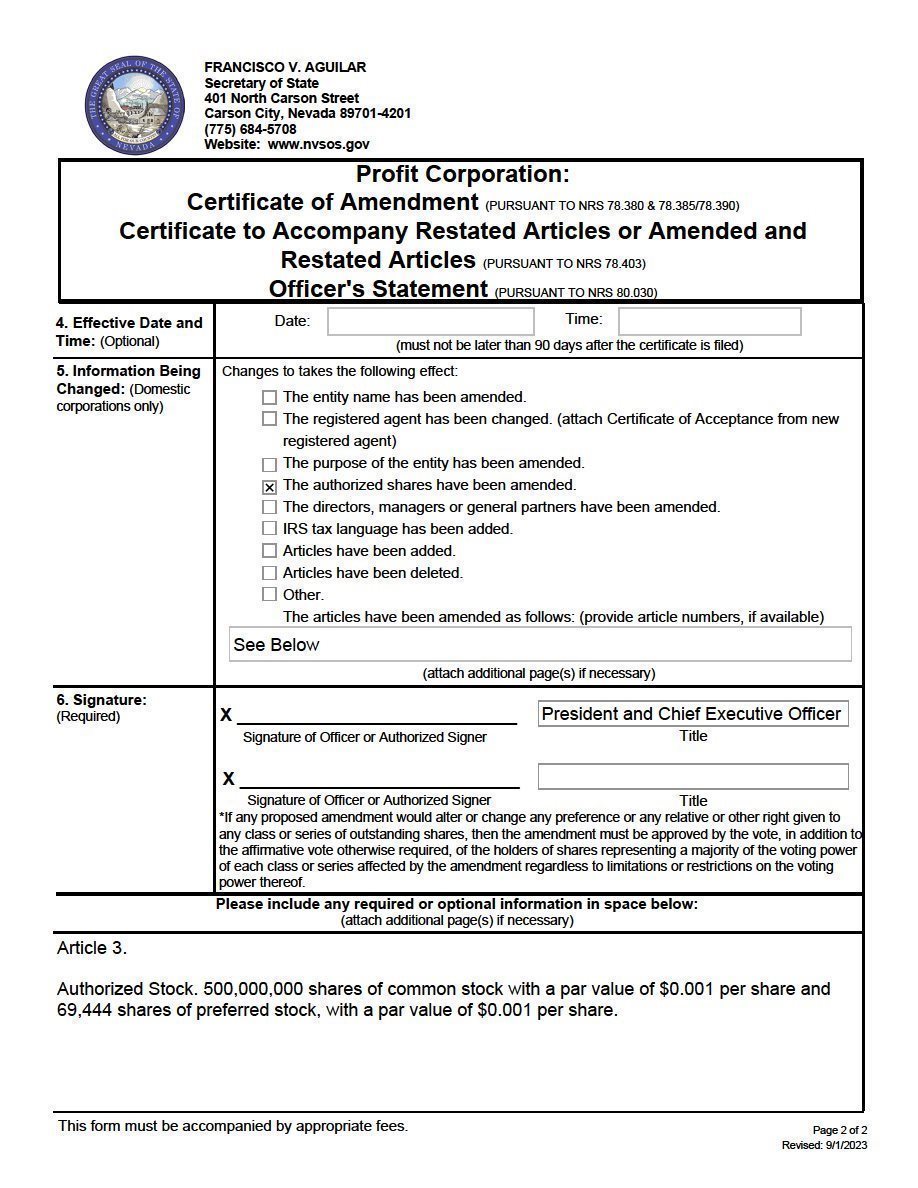

The Articles of Incorporation of Artelo Biosciences, Inc. a Nevada corporation (the “Corporation”), as filed with the Nevada Secretary of State on May 2, 2011, and as amended from time to time, shall be and hereby is amended as follows:

RESOLVED, that Article 3 of the Corporation’s Articles of Incorporation, as amended, be and hereby is amended and restated in its entirely as follows:

“3 Authorized Stock. [500,000,000]1 shares of common stock with a par value of $0.001 per share and 10,000,000 shares of preferred stock, with a par value of $0.001 per share.

3.1 Preferred Stock. The shares of the Corporation’s Preferred Stock may be issued from time to time in one or more series of any number of shares, provided that the aggregate number of shares issued and not retired of any and all such series shall not exceed the total number of shares of Preferred Stock hereinabove authorized, and with such powers, including voting powers, if any, and the designations, preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions thereof, all as shall hereafter be stated and expressed in the resolution or resolutions providing for the designation and issue of such shares of Preferred Stock from time to time adopted by the Board of Directors of the Corporation (the “Board”) pursuant to authority so to do which is hereby expressly vested in the Board. The powers, including voting powers, if any, preferences and relative, participating, optional and other special rights of each series of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding. Each series of shares of Preferred Stock: (a) may have such voting rights or powers, full or limited, if any; (b) may be subject to redemption at such time or times and at such prices, if any; (c) may be entitled to receive dividends (which may be cumulative or non-cumulative) at such rate or rates, on such conditions and at such times, and payable in preference to, or in such relation to, the dividends payable on any other class or classes or series of stock, if any; (d) may have such rights upon the voluntary or involuntary liquidation, winding up or dissolution of, upon any distribution of the assets of, or in the event of any merger, sale or consolidation of, the Corporation, if any; (e) may be made convertible into or exchangeable for, shares of any other class or classes or of any other series of the same or any other class or classes of stock of the Corporation (or any other securities of the Corporation or any other person) at such price or prices or at such rates of exchange and with such adjustments, if any; (f) may be entitled to the benefit of a sinking fund to be applied to the purchase or redemption of shares of such series in such amount or amounts, if any; (g) may be entitled to the benefit of conditions and restrictions upon the creation of indebtedness of the Corporation or any subsidiary, upon the issue of any additional shares (including additional shares of such series or of any other series) and upon the payment of dividends or the making of other distributions on, and the purchase, redemption or other acquisition by the Corporation or any subsidiary of, any outstanding shares of the Corporation, if any; (h) may be subject to restrictions on transfer or registration of transfer, or on the amount of shares that may be owned by any person or group of persons; and (i) may have such other relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, if any; all as shall be stated in said resolution or resolutions of the Board providing for the designation and issue of such shares of Preferred Stock.”

___________________________

1 Note: if the Proposal for the Increase Shares Amendment is approved the number of shares of authorized shares of common stock will be 500,000,000 shares; however, if such proposal is not approved then the authorized number of shares of common stock will remain at 8,333,333 shares.

| B-3 |